- Home

- >

- Daily Accents

- >

- Bank Of America: The tech sector will be the next Market Bubble

Bank Of America: The tech sector will be the next Market Bubble

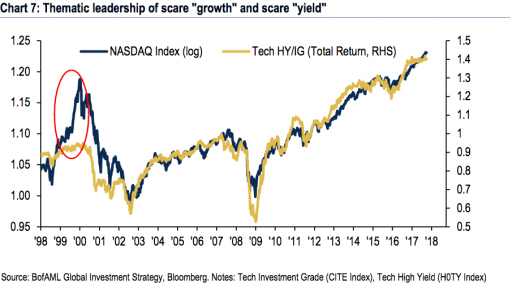

If you're looking for the next Market Bubble, it's a good idea to look into the technology sector and pay special attention to the returns of technology companies' stocks and bonds. As is clear from the graph, the Nasdaq technology index moves in line with low-quality bond and industry-focused investment. This is not always the case. During the dot-com balloon, the yield of the shares rose significantly while the bond yield remained static. According to Bank Of America Merrill Lynch, traders should monitor this dependence very carefully, and in case of bigger deviations, they should do the job to defend their positions.

Overall, in history, three similar bubble cases in the technology sector show up after a strong rise in the value of stocks and bonds.

- Japan 1989 Nikkei rose 31%, yielding on Japanese government bonds rose by 170 points.

- United States 1999 - Nasdaq Composite grew by 230%, while government bonds rose by 220 basis points.

- China 2007 - The Shanghai Composite Index grew by 200% and Chinese bonds jumped by 160 basis points.

In addition, Bank of America's chief investment strategist, Michael Hartnett, makes medal proclamations after a bank survey shows that a record number of investors take a higher than normal risk.

What is happening at the moment?

Looking at the Nasdaq earnings chart and the bonds in the sector, it is clear that the shares have a higher yield than the bonds. Looking back in time, it has been seen that such an overtaking has not existed since 2007. after which the markets went into correction. Taking this into account and the record high yield achieved by the sector in 2017, we expect a slight adjustment that lasts to balance the yields between the stock and the bonds. However, technology companies are in good health and a possible adjustment in the sector would give us a good opportunity to buy "on cheap".

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.