- Home

- >

- Fundamental Analysis

- >

- Bank of Japan is likely to keep its current monetary policy – still low inflation

Bank of Japan is likely to keep its current monetary policy - still low inflation

Bank of Japan will most likely maintain monetary policy without changing its two-day session, which will end on Thursday. The challenge for the bank remains the same, namely weak inflation. BoJ chairman Haruhiko Kuroda is likely to send a signal to investors for more patience.

This time, however, there are two interesting events that will affect the JPY, one of which is the decision of the Fed to diminish its balance. If FED shows investors that there is a way to diminish their balance, this will lead to a rise in the dollar and a weakening of the yen, and a weaker yen is welcome for future reform of Japan's monetary policy.

The second event is that two new members join the board of BoJ. New additions to the BoJ are supporters of Kuroda's policy, but they are able to turn the vote and moods into the central bank, which will lead to the yen's appreciation.

The economy is currently working in favor of the central bank and the idea of tighter monetary policy. The consensus forecast for the country's GDP in Q3 rose to 1.2% against 0.8 in Q2. Other positive signals come from strong manufacturing production and a strong labor market.

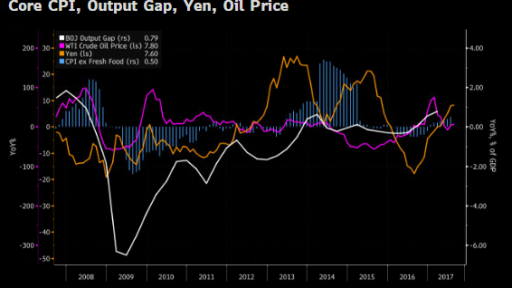

A key issue for BoJ remains low inflation, which is expected to reach 0.5% by the end of Q3. Kuroda's hopes are that production in the country will remain at high levels, and that oil can keep above $50 a barrel. Under this scenario, inflation will be able to reach 1% by October, but will still be far from the desired 2%.

Looking ahead, the development of the Fed's downward balance and the BOJ's control of the yield curve would likely lead to a yen devaluation in the short run. In the near future, growing tensions with North Korea increase the risk of market shock and a sharp appreciation of the Japanese yen, as it is one of the safest haven tools for uncertainty.

BoJ is likely to begin to maintain a flexible position on QE in the country, and at this week's session will leave the amount of 80 trillion yen a year unchanged to keep yields on 10-year bonds around current levels. Lower market yields will allow the BoJ to start reducing the amount of purchases, but this would only happen when the Fed starts to reduce its balance.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.