- Home

- >

- Stocks Daily Forecasts

- >

- Banks face a reality check, and we could learn the Trump rally is ‘pretty much dead’

Banks face a reality check, and we could learn the Trump rally is 'pretty much dead'

Investors may soon learn that the Trump trade is dying as the big banks start reporting their second-quarter earnings results this week.

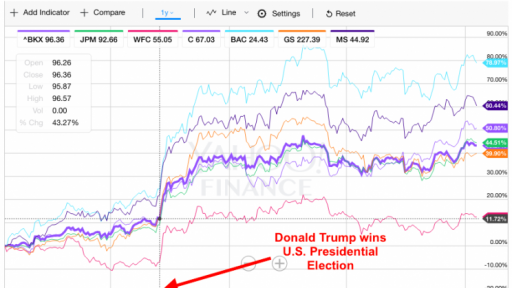

JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) kick off earnings season for the big banks on Friday, while Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS) report their results next week.

The bank stocks were some of the biggest beneficiaries of the Trump rally, but while the stock prices have benefitted, the companies themselves haven’t.

“It has not benefitted company earnings because loan volume is weak, loan losses are going up, trading activity is disappointing,” said Dick Bove of Rafferty Capital Markets. “So while people may have been very optimistic and purchased the stocks on the expectation of what will happen, it hasn’t happened, and it’s unclear if it will ever happen.”

For Bove, the Trump rally right now is “between hold and dead.”

“I think the reason is because there’s no real conviction left that there’s going to be a healthcare bill, a tax cut, a tariff, fiscal stimulus, a wall built,” said Bove. “It doesn’t appear that any of these things are going to happen in the short run. Many are not going to happen at all. Some may happen, but in a truncated form. The net effect is I don’t think anyone is buying bank stocks on the Trump rally.”

KBW Nasdaq Bank Index (^BKX) rose 3.9% during the second quarter, bringing its return for the first half of the year to 4.2%. The S&P 500 gained 8.2% in the first half of 2017.

Rafferty’s Bove pointed out that bank stocks peaked on March 1 and plummeted for a period of time on the recognition that earnings were not going to be that good. Last month, there was a raft of positive information about the safety of the banking industry when they all passed the Fed’s stress tests. There were also announcements of increased dividends and stock buybacks. They have since regained some of those losses, but they’re still below where they were on March 1.

The question is what’s going to drive them over the next few quarters? I think the answer is earnings,” said Bove.

For the second quarter, Bove expects it to be “mediocre” with flat and slightly higher earnings.

“The engine behind the growth in lending in the last couple of years has been on the commercial and industrial side. I think we are seeing a slow down there,” said Stemm.

Loan growth is a key driver for bank revenues. The deceleration from both the consumer and the commercial and industrial side could be indicative of the industry getting later into the business cycle.

Going forward, Bove expects that loan volume will stay weak, loan losses will increase meaningfully, and that banks will have to worry about the cost of deposits going up sharply.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.