- Home

- >

- Market Rumours

- >

- Barry Bannister: Stocks will probably sink in December and recession will hit in May

Barry Bannister: Stocks will probably sink in December and recession will hit in May

As the US yield curve turns and shakes the market, it is debated whether the recession warning sign is valid. Stifel's head of institutional capital, Barry Bannister, says that's the case and the consequences will be more dire than most people imagine.

In a statement to clients, he said the stock is likely to sink in December and that the recession will come in May. He then sees a "dangerous" market where the S&P 500 can deliver a 0% return for the next five years. An inversion of the yield curve occurs when short-term bonds have higher returns than longer-term ones, and this is a sign that investors are very concerned about the economy.

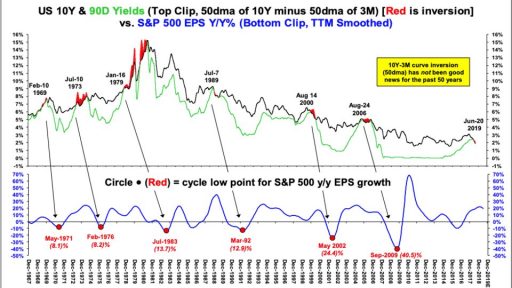

Because this has happened before each of the last seven recessions, it is considered one of the most credible signals of a recession. And that has recently erupted as the trade war has pushed investors to flee to safer assets. But Bannister notes that there have been several false reports over the years. So he uses a different measurement of the yield curve, which he thinks is more accurate: a 50-day moving average spread between 3-month and 10-year bonds. He says this version correctly predicts every recession in the last 50 years, without a single wrong signal.

He says this measurement of the yield curve shows that the inversion happened on June 20. Its forecasts and timing of the market sell-off and recession are based on historical averages of what happened before the previous downturns. "If a recession occurs in May 2020, stocks may shake as early as December 2019, the standard time of onset of the recession," Bannister wrote. He also said the average drop would be 26% in S&P 500 earnings and a 32% drop in the index itself. That sounds bad enough, but Bannister adds that the combination of low interest rates and stock buybacks pushes stock valuations to very high levels, leaving little room for profit in the years to come. "The S&P 500 is at the top of the range provided by our 10-year model," he writes.

Source: BI

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov If you think, we can improve that section,

please comment. Your oppinion is imortant for us.