- Home

- >

- Stocks Daily Forecasts

- >

- Bear Market Rally Or Start Of A New Bull on S&P500? What To Look For

Bear Market Rally Or Start Of A New Bull on S&P500? What To Look For

Recent sentiment data shows investors to be more pessimistic than they have been in at least 4 years. Some sentiment data is the most extreme in 14 years. A recent post on this here.

The rub with this data is this: some of these sentiment extremes in the past came at the start of new bull markets and some only marked the start of a rally within an ongoing bear market. Let's assume that the rally now is only a bear market rally. What might it look like?

Bear market rallies can be as short as a week or last as long as 3 months. Gains are at least 7-8% and can be as much as 20% or more.

In real time, distinguishing a bear market rally from the start of a new bull market can be tricky. It's not unusual for the 50-dma to turn around and begin rising. After a 3 month rally, the bear market decline that preceded it can feel like a long time ago, making investors once again optimistic and bullish.

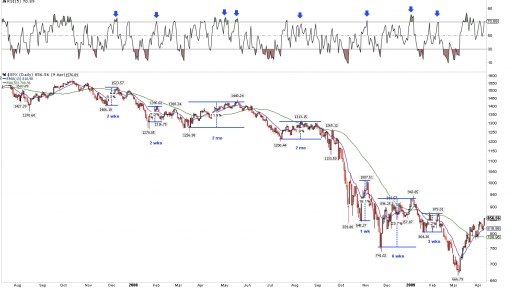

Let's look at the 2008-09 S&P 500 bear market first:

There were seven bear market rallies during a period of just 14 months, and three of these lasted 6-8 weeks.

That means there was a rally about every other month.

All except one made it back to the 50-dma (green line).

Gains were a minimum of 7-8% and two gained 20% or more.

Each of these rallies had a hard time staying overbought. These rallies generally started to fail as soon as RSI(5) exceeded 70% (top panel). The one exception was the March-May 2008 rally, which was strong enough to turn the 50-dma upwards. That gain was 12%.

The 2000-02 bear market is shown below:

There were seven bear market rallies during a period of 24 months.

All of them lasted at least a month and two lasted 3 months.

There was usually a rally every other month, although two rallies were 4 months apart.

Each one made it back to the 50-dma (green line), which started to rise on four different occasions.

Gains were a minimum of 8-9% and four were 20% or more.

There was a bear market rally until last Thursday. We will be watching to see if RSI(5) can remain overbought (top panel). This will be a good sign. A rising 50-dma will also be a good sign, but be mindful that it has given a false sense of security during bear markets in the past.

Investing

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.