- Home

- >

- Great Traders

- >

- Beginning of statistical arbitrage – prof. Ed Thorp

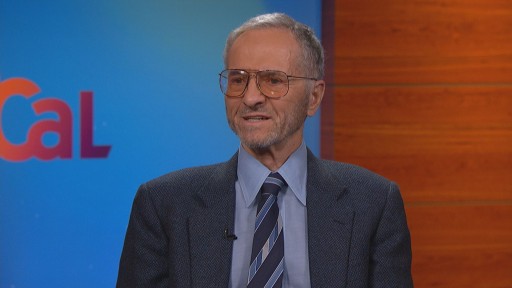

Beginning of statistical arbitrage - prof. Ed Thorp

In the world of financial investment is extremely popular "statistical arbitrage", although the term is often used too freely and within a very different context.

Professor of Mathematics and Finance is one of the most famous hedge fund managers. Fund "Princeton Newport Partners", in the 80s showed unprecedented success today, which sharply separates the results achieved by Thorpe to other managers. The result is 227 months to win only 3 losers, and that with the loss of 1%. This is really incredible indicator - approximately 98.7% of the time is complete profit by the weighted average annual yield is over 19%.

Ed Thorpe (Edward Oakley Thorp, born 14 August 1932) in 1979 began a study of the stock market in search of indicators having any predictive properties. Establish a list of 30-40 items that begin to refine. Within this process compares the shares with the highest level of growth and decline. Thorpe subsequently a tendency that most pricey shares slow its movement against the trend of the overall market, while at the depressed securities within the next period showed yield above the market average. On this base is made strategy contained a long position in the most plummeting cost tool with a short position in the most sharply rose. Group Thorpe calls this strategy "the most expensive and the cheapest", where it appears the maxim that successful speculator is one who buys cheap and sells dear. There arises one of the directions (Pairs trading) in market-neutral strategies.

Many speculators and investors continue to believe that there should be a universal model of price fluctuations, something like "Holy Grail". Development of Thorpe in statistical arbitrage are a perfect example that variables do not require models and adaptation of trade to market changes. The initial idea of arbitration Thorpe is to balance the long position in the most depressed stocks to short the most pricey in such a way that the total maximum approximation approach zero. When the ratio yield / risk in this strategy began to decline, he flips the modification of the arbitration concept, seeking neutrality of the total position within the entire sector of the market. When this approach is limited, he added neutrality to several other factors.

The long-term foundation for successful strategies of prof. Thorpe proved flexibility and its constant readiness for change in approach when changes occur in the market. So he managed to maintain relatively constant and very high correlation coefficient of yield at ris

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.