- Home

- >

- Stocks Daily Forecasts

- >

- Bets against Micron continue, the semiconductor sector has not yet found its bottom

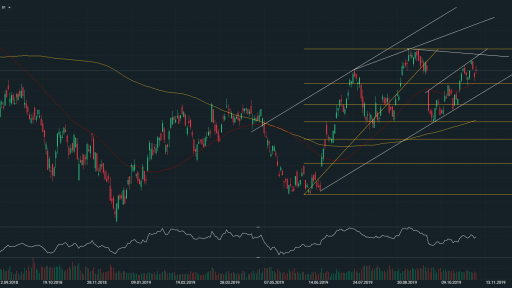

Bets against Micron continue, the semiconductor sector has not yet found its bottom

Micron's stock is continuing its upward trend, especially after the positive US-China news. The semiconductor sector remains one of the worst because of the trade war, but Wall Street is beginning to believe that the sector has reached its bottom.

Option traders, however, still have low expectations for MU next year.

In yesterday's session, activity in the options market showed that the trader at 9:49 AM bought 1080 Micron put options with a strike of $ 45, ending April 17, 2020. The whole bet was worth $ 388,800.

20 minutes later another trader bought 500 put options with a strike of $ 46, due on January 17, 2020. The bet was for $ 118,500.

At 11:19, the trader is buying 1500 MU call options with a strike of $ 48, expiring December 20. The bet is for $ 495,000.

The overall activity of the options shows that traders remain rather bearish on MU and the sector.

The day before the options market intensified against MU, SMBC announced an outperfomr rating of $ 62.

The company reported a 30% QQ increase in DRAM sales, but prices remained down by 20%. NAND sales also showed a double-digit increase, but prices remained low compared to the previous quarter.

The short-term rise in MU is due to the stabilization of the memory card market, but the bears do not expect this to continue into 2020.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.