- Home

- >

- Daily Accents

- >

- Big banks positive for the euro after the French elections

Big banks positive for the euro after the French elections

Forget the politics. For the euro, it’s all about growth in Europe’s economy.

With Emmanuel Macron’s victory in France dousing risks of a euro breakup, banks are more bullish on the currency given the region’s improving growth and the prospect that the European Central Bank may taper economic stimulus. UniCredit SpA and ING Groep NV raised their forecasts for the euro this week after Sunday’s second-round vote in France, following Bank of America- Merrill Lynch and Credit Agricole SA that had done so earlier.

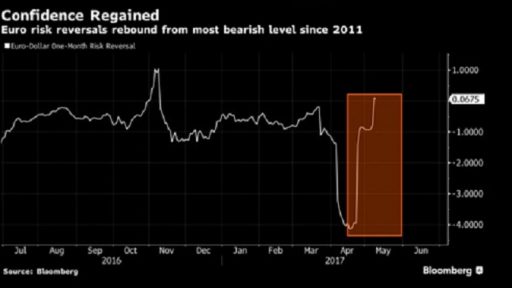

Option-market sentiment on the euro rebounded from the most bearish since 2011 after Macron defeated far-right presidential candidate Marine Le Pen in France, ending the threat of a political upset similar to Brexit. Euro-area economic confidence jumped to a decade high in April, and analysts predicted last month that the first hints of an ECB plan to exit its asset- purchases program, known as quantitative easing, could come as early as next month.

“We now expect markets to start focusing on the ECB’s plans to taper QE after the current program expires in December,” said Athanasios Vamvakidis, head of Group-of-10 currency strategy at Bank of America-Merrill Lynch in London, who has raised his year-end euro forecast by almost 3 percent. “The quantitative- easing tapering should support the euro.”

The common currency has rallied more than 2 percent versus the dollar since Macron’s win in the first-round vote on April 23 to $1.0890, taking its gains for the year to 3.6 percent, the best performance after the pound among Group-of-10 exchange rates.

The cost of one-month options to buy the euro against the greenback has surged, relative to contracts for selling, to minus seven basis points from a 5 1/2-year low of minus 413 basis points on April 18. The so-called risk-reversal rate was the most bearish for the euro among global currencies on April 21.

Forecasts Raised

Bank of America lifted its year-end euro forecast by almost 3 percent after France’s first-round vote to $1.08, and that for end-2018 by 4.5 percent to $1.15, according to a note to clients on May 1. The bank favors euro-bullish trades versus the yen rather than the dollar given that the Federal Reserve is set to raise interest rates.

Credit Agricole boosted its end-2017 projection to $1.12 from $1.10, according to a May 5 report, while UniCredit revised its call 3.6 percent higher to $1.14. ING sees the euro rallying to $1.15 in the third quarter of this year and to $1.20 by mid-2018, London-based strategist Petr Krpata wrote in a May 9 note.

UBS Wealth Management is maintaining its overweight position on the euro versus dollar, according to a note on May 7. Last week, JPMorgan Chase & Co. added a long-euro position against the Australian dollar, according to a report dated May 5.

Italian Vote

Euro breakup risks may soon resurface when Italy will go to polls next year, according to Citigroup Inc.“Italian elections have flown under the radar screen recently but there is a strong possibility that the Five Star Movement could become the largest party in parliament after the next election,” economists at Citigroup including Guillaume Menuet wrote in a May 5 note. “Euro breakup risk will probably hit the headlines again.”

Still, the vote in Italy is too distant a prospect to command a risk premium in the currency, according to strategists including JPMorgan’s Paul Meggyesi.

With French political risks out of the way, “we expect European markets to refocus on the economic recovery and a gradual reduction of monetary stimulus,” Mark Haefele, Zurich- based global chief investment officer at UBS Wealth, wrote in the note.

Source: Bloomberg

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.