- Home

- >

- Cryptocurrencies / Algotrading

- >

- Biggest Crypto analysts on Wall Street are stopping their Crypto forecasts

Biggest Crypto analysts on Wall Street are stopping their Crypto forecasts

In order to gain an idea of how severe the Bitcoin analysts were in 2018, it is enough to look at Tom Lee's latest cryptotrader analysis.

"We have tired of people asking us constantly what our price target is." - says co-founder of Fundstrat Global Advisors. "Because of the inherent volatility of the crypto markets, we stop giving estimates of price movements over a certain period of time."

In other words, Wall Street's most famous Bitcoin analyst dropped his estimates for Bitcoin.

This is not surprising and we could easily understand why this solution has been reached. An overview of Tom Lee's latest analysis shows that he had a $ 20,000 price target for Bitcoin in 2018 and a $ 25,000 forecast at the end of the year. By the time he lowered his target to $ 15,000 in November, Bitcoin was already trading at $ 5,500. Since then, the price has fallen to about $ 4,000, down more than 70% since the beginning of the year. Lee's latest average score is a range from $ 13,800 to $ 14,800.

He is not the only one who has not hit his predictions. Analysts from BitMEX to Galaxy Digital, respectively Arthur Hayes and Mike Novogratz were too bullish this year. The crypt of 2017 quickly vanished after concerns about the rise in regulations, ongoing hacker attacks, and weak demand from institutional investors. The pessimists did much better with their forecasts, though they had problems with accurate price forecasting.

Below are the predictions of the biggest names in the Crypto industry:

The former Citigroup trader, who has become a Crypto Magnet, has gathered waves of followers with his $ 50,000 forecast in May, but admits that the market could get worse before it gets better.

"I was bullish and I chose a nice, round figure of psychological significance." - writes Hayes in a mail to his followers. "Obviously, however, we are currently in a bear market."

Hayes said he would wait to see what Bitcoin's performance would be in January before making a full estimate for 2019.

In November 2017, the former Goldman Sachs partner told CNBC that Bitcoin would easily reach $ 40,000 by the end of 2018. In October, however, Novogratz was already calling for a $ 9,000 ceiling. Since then, he has further reduced his Target.

The sale had an extremely negative effect on its Crypto Commercial Bank. Net realized and unrealized losses on digital assets of Galaxy Digital Holdings amounted to $ 136 million in the first nine months of 2018. Novogratz made a new optimistic forecast on November 30. "I think fundamentally, Bitcoin will experience a period of strong perception in 2019, 2020"

The global macro strategist has won a lot of fans among the Crypto community after predicting that Bitcoin will reach $ 2,000 in 2017. His January forecast predicted a $ 100,000 increase and was based on the expectation that regulated futures will be introduced in the United States, which can attract institutional investors.

Quinlan уцели посоката за 2018 г., макар и прогнозата му да се окаже прекалено песимистична, наближавайки края на годината.

Гледайки напред, Quinlan вижда допълнително обезценяване на оригиналната крипто валута. Bitcoin най-вероятно ще поевтинее до $1 000 през следващата година, преди да достигне и $810 през 2020 г. Един от дългосрочните рискове е, че правителствата ще успеят да разработят свои собствени дигитални валути и така ще ограничат влиянието от децентрализирани монети.

Quinlan hit the direction for 2018, though his forecast was too pessimistic, approaching the end of the year.

Looking ahead, Quinlan sees further depreciation of the original Cripp currency. Bitcoin is likely to fall to $ 1,000 next year before it reaches $ 810 in 2020. One of the long-term risks is that governments will be able to develop their own digital currencies and thus reduce the impact of decentralized coins.

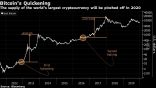

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.