- Home

- >

- Fundamental Analysis

- >

- Bill Gross says another credit crisis could be just around the corner

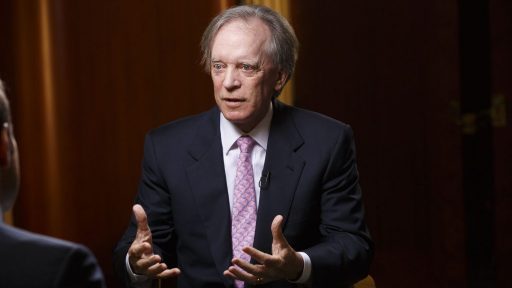

Bill Gross says another credit crisis could be just around the corner

In his latest investment outlook, Gross, who manages the Janus Global Unconstrained Bond fund, shares an amusing analogy he concocted while sitting with his children and grandchildren. Gross abruptly left Pimco, the firm he founded and ran for four decades, in 2014 following an acrimonious fallout with other executives at the firm.

Here’s Gross:

“Pretend...the bank owes you a buck any time you want to withdraw it. But the bank says to itself, “she probably won’t need this buck for a while, so I’ll lend it to Joe who wants to start a pizza store.” Joe borrows the buck and pays for flour, pepperoni and a pizza oven from Sally’s Pizza Supplies, who then deposits it back in the same bank in their checking account. Your one and only buck has now turned into two. You have a bank account with one buck and Sally’s Pizza has a checking account with one buck. Both parties have confidence that their buck is actually theirs, even though there’s really only one buck in the bank’s vault. The bank itself has doubled its assets and liabilities. Its assets are the one buck in its vault and the loan to Joe; its liabilities are the buck it owes to you – the original depositor – and the buck it owes to Sally’s Pizza. The cycle goes on of course, lending and relending the simple solitary dollar bill (with regulatory reserve requirements) until like a magician with a wand and a black hat, the fractional reserve system pulls five or six rabbits out of a single top hat.

Each of the depositors mentioned above believes he can retrieve this dollar from the bank’s vault whenever he likes. But that’s not exactly true, Gross says.

Gross’s ultimate point is this: Another Lehman-type situation could soon befall the global economy if it doesn’t rein in what Gross considers rampant credit creation.

The U.S. economy has created more credit relative to gross domestic product than existed during the run-up to the financial crisis. Many experts cite Lehman’s decision to file for bankruptcy on Sept. 15, 2008, as the spark that ignited the crisis. In China, the situation is even more dire: The world’s second largest economy has added $24 trillion worth of debt to its collective balance sheet since 2007, swelling its total debt ratio to 300% of GDP.

Central banks attempt to ward off disaster by walking a fine line: Keeping the cost of credit low enough so it doesn’t choke borrowers, but high enough to help retirees and other savers meet their liabilities.

At least when the 2008 crisis broke out, central banks were able to slash interest rates and unfurl a massive bond-buying program to help breath life back into credit markets.

But today, global borrowing costs remain extremely low by historical standards, and the postcrisis asset-purchasing programs adopted by central banks are nearing their natural limits.

So don’t be fooled by President Donald Trump’s promises of 3-4% economic growth, or allow the fact that U.S. stocks SPX, +0.08% are trading at all-time highs to lull you into a false sense of security, Gross warned his investors.

MarketWatch

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.