- Home

- >

- Daily Accents

- >

- Bitcoin – Now I Get it

Bitcoin - Now I Get it

Man, if anything needs the “now I get it” treatment, it’s Bitcoin. You hear about it all the time in financial and technical circles —but most people really don’t grasp it.

Bitcoin is an alternative kind of currency. It’s entirely digital—there’s no paper money, there’s no coins, nothing physical, not even a plastic card for your wallet. Your bitcoins are stored on your computer or your phone. If your hard drive crashes without a backup, you lose your bitcoins.

This arrangement has some stunning advantages over traditional currency or credit cards:

- Between buyer and seller, there’s no bank or credit-card company involved, no middleman who can charge fees. The entire Bitcoin banking system is a global peer-to-peer network, running Bitcoin software.

- When you buy something from someone in another country, there’s no waiting to convert currencies—and again, no fees.

- All transactions are essentially anonymous, which is super convenient if you’re a drug dealer or arms dealer.

There’s a whole lot of really cool, really complicated math involved in Bitcoin, designed to keep it secure and to prevent Bitcoin inflation.

For example: the complete record of all Bitcoin transactions—a massive digital ledger called the blockchain—is stored on all Bitcoin users’ computers, rather than being held by a central authority.

Bitcoin was born in 2009, the proposal of an anonymously written white paper. There’s no government to decide when to print new money in this case, so new bitcoins are “mined”—created—through a complex scheme you can read about here. In essence, anyone can create new bitcoins, but don’t think you’ll get rich that way. The job requires massive, expensive, high-horsepower computers that must slog through gigantic calculations to “mine” new money. The complexity of the math involved is adjusted so that it’s just barely profitable to mine bitcoins, and so that only a few bitcoins come into existence every 10 minutes.

This production will stop when there are 21 million bitcoins on earth, which is supposed to happen around 2140. After that—that’s all the bitcoins there’ll ever be.

So how do you get bitcoins? Same way you get euros or yen or pesos: You buy it with traditional currency like dollars. You can use online exchanges like Bitstamp and Coinbase. At this writing, one bitcoin costs about $1,078.

What to do with bitcoins

When you get a Bitcoin address—something like an email address—you also get a complex password known as a private key, which you need to access your stash.

At that point, you can transfer money to other people by sending it to their Bitcoin addresses.

You can also pay for goods and services at some merchants, like Subway and Xbox; they’re delighted when that happens, because they don’t lose 3% of the transaction in credit-card fees. But in the big picture, the list of places that accept Bitcoin is fairly small. And you don’t get any particular benefit by paying for something this way.

Bitcoin as an investment

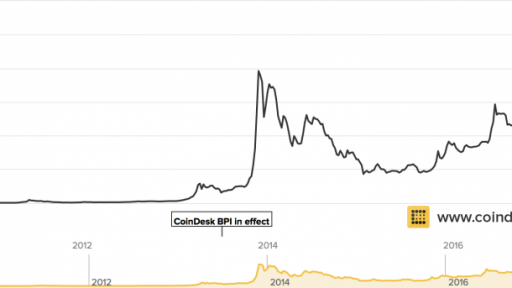

The good news is that since Bitcoin’s creation eight years ago, its value has gone up by quite a bit—from well under a penny to over $1,000 per bitcoin today.

The bad news is that its value is incredibly volatile. Remember this past January, when it dropped by a fifth in a day? Good times.

Should you dive in?

So: Bitcoin is fascinating, but it’s not very useful, at least not to most people. Some people love it, for sure, like investors with a taste for risk, tech-savvy early adopters, technically-minded libertarians, and criminals.

But keep in mind that there are lots of exciting ways to lose all your bitcoins. Like if your hard drive crashes without a backup, and you lose your private key. Or if you get a Bitcoin virus, of which there are now many. Or if your Bitcoin exchange goes out of business, which has happened plenty; in fact,18 of the first 40 exchanges had gone under as of 2013, taking all their clients’ money with them.

Remember, this whole thing is largely unregulated. If you buy something with a credit card and you get ripped off, you can call an 800 number and the credit-card company will get your money back. But if you get ripped off with a Bitcoin transaction … sorry! You voted for no middleman, remember?

In the meantime, for most people, Bitcoin is a fascinating development that’s a worthy topic of study—just not for ownership.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.