- Home

- >

- Cryptocurrencies / Algotrading

- >

- Bitcoin’s real activity remains to be speculative

Bitcoin's real activity remains to be speculative

Bitcoin has begun to put an issue on the agenda that seems to have escaped the majority in recent weeks, and against the backdrop of the renewed rally.

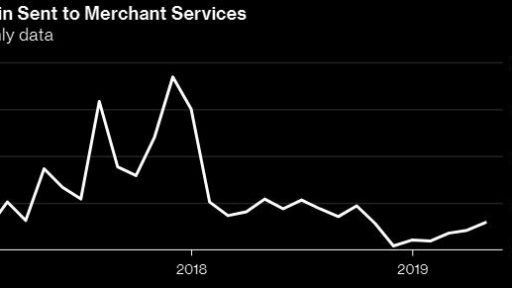

Hardly anyone uses the biggest crypto in the world for anything but speculation. Chainalysis data shows that only 1.3% of transactions came from merchants in the first four months of 2019, a minor change compared to the peak period two years ago.

Although renowned companies such as AT&T now offer the option of crypto payment, speculators would rather like a new jump of at least 50% in the Bitcoin price rather than being paid to the wireless provider. This phenomenon creates an already anomalous attitude towards digital currencies. Bitcoin needs the necessary noise and euphoria to attract the masses and to perceive him as a good substitute for electronic payments. Instead, however, the culture of so-called. "holders". They rather hold their digital currencies for accumulation instead of spending.

Chainalysis says Bitcoin's economic activity continues to dominate in the trade. This means that the utility still remains purely speculative. The daily consumption of crypto remains far from real.

Chainalysis uses BitPay data, which provides crypto payment service to merchants. According to BitPay, they processed payments to AT & T for $ 1 billion in 2107 and 2018.

Actually what is happening. A client pays in BitPay Battles that verify the payment and accept the bots on behalf of the company to which the payment was made. Then this firm has the right to accept them as a battle, such as a fiat currency or to make a split. If the company chooses a 100% fiat currency to receive, the dollars are deposited into the company's account the next business day, with BitPay having 1% commission for the entire process. The company is protected against the volatility of the crypto markets.

While BitPay volumes appear to be significant, Visa has processed half a billion transactions a day for the past year and processed a total of $ 11.2 trillion in 2018.

Trading activity still remains low than its peak in late 2017. Then merchants accounted for 1.5% of Bitcoin's total activity. With the bubble popping in crypto, activity dropped by 0.9%.

Transactions on trading sites still account for the highest activity of 89.7% from January to April 2019. This downward trend in real consumption and economic activity may be quite problematic for Bitcoin's future. His creator, Satoshi Nakamoto, imagined how he paid everything with the battlefields - from buying coffee to buying cars. However, facts distancing his vision from reality. Even lately, Bitcoin is becoming more and more the digital version of gold - an asset that increases its value in times of economic uncertainty, even though Bitcoin has no correlation with stocks and bonds. For the moment, this remains more a dream than a real comparison with gold.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.