- Home

- >

- Daily Accents

- >

- BlackRock, Capital Group and Pimco with pessimistic forecasts for 2019

BlackRock, Capital Group and Pimco with pessimistic forecasts for 2019

The US stock market has not looked so bad for a decade. The credit market is also very risky. Volatility has returned. For many, cache and short-term debt are the best places to protect.

With the approach of 2019, many corporate leaders, portfolio managers and strategists are starting to look ahead to the next year's prospects with great caution and realize that the risk that profits and returns may be lower for some asset classes. Furthermore, they sincerely encourage investors to be careful when choosing where to invest. Below we can see their recommendations and opinions.

Jurrien Timmer

Fidelity Investments, director of global macro

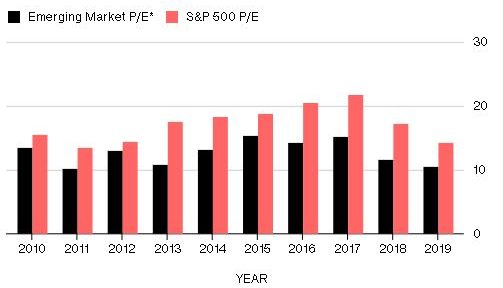

In 2019, growth in corporate profits will shrink from 7 to 5 percent. The Fed will raise interest rates once or twice, and the stock-market rates will start at a relatively acceptable level. Securities look the best in the whole situation. Shares should do better than in 2018. The best opportunity to invest in shares should be in emerging markets that are lagging behind the US.

Rob Lovalace

Capital Grup, vice chairman and equity portfolio manager

Take a look at companies that make devices such as Apple that are great until they stop being such because of the lack of product diversity. In contrast, Samsung Electronics not only makes headphones and small devices, but has a wide range of products including chips. Select the stocks separately, instead of trading the index. For example: Revolutionary discovery in the world of bio-tech and pharma companies in the fight against cancer. Instead of concentrating on specific companies, we invest in many companies in the sector. So we will be able to reach those with spectacular discoveries and those who are currently testing for third-degree drugs.

Kristina Hooper

Invesco Ltd, chief global market strategist

Buy stocks from emerging markets, technology stocks, shares that pay dividends and alternative assets such as: real estate, resources like gold. Sell or limit exposures to US stocks, mostly to stocks heavily dependent on consumption. Hooper's main motive for this strategy is that it believes global growth is declining, but it will remain stable, with a slowdown in the US. It also expects low but positive returns from the markets.

Dan Ivascyn

Pacific Investment Management Co, group chief investment officer

Beware of the rise in volatility, the expansion of spreads in the credit market and the equalization of the yield curve. These are signs of economic deterioration over the next 12 to 24 months. Increase your cache position and wait for the opportunity.

Jefrey Gundlach

DoubleLine Capital, CIO and CEO

Avoid US stocks and corporate debt and focus on long-term securities, as interest rates are likely to continue to rise. The best choice in this case will be high-quality, low-duration, low-volatility fund management.

Richard Turnill

BlackRock Inc, global chief investment strategist

For stocks, we like the quality: good cash flow, stable growth and clean reports. The United States is certainly a preferred region, but now we see that emerging markets offer improved risk conditions. With fixed yield, US government debt can be added as a ballast against the lack of risk in the late stage of the economic cycle. We prefer short- or medium-term bonds. Avoid European stocks.

Bill Stromberg

T. Rowe Price Group Inc, CEO

The American stocks had a very good series. For the next 10 years, an annual return of 5 to 7% will be acceptable. Shares in emerging markets are cheap and have a bigger dividend. You can get 8 to 10% return over the next 10 years.

Joseph Davis

Vanguard Group, chief global economist

We expect a slowdown in the economy, but not a recession for the US as well as the world. US growth will slow to 2%. We will hardly see an increase in inflation because wages will not rise with much.

Omar Aguilar

Charles Schwab Investment Management, CIO of equities and multi - asset strategies

Avoid or sell shares with a small market share, high yield bonds and debt assets. Invest in stocks that have a dividend and steady growth in sectors such as healthcare, consumption and regional banks. Emerging markets are also preferred.

Dan Fuss

Loomis Sayles & Co, vice chairman

Follow Europe and the beginnings of division into the EU. Especially what is happening in Germany and France. In the short term, you have to watch Europe because it affects the European Central Bank. In the long run, you need to monitor what is happening in the EU and whether the region will further weaken.

Source: Bloomberg Finance L.P.

Graph: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.