- Home

- >

- Daily Accents

- >

- BlackRock does not give up tech stocks

BlackRock does not give up tech stocks

BlackRock remains a bullish attitude towards technology stocks. While a lot of investors backed off because of the challenges they met after reporting a bad 2018, BlackRock remains the long-term trend.

"We do not give up on technology." - says Kate Moore, a strategist at BlackRock. "The technology sector is still liked and loved by us and by many other investors."

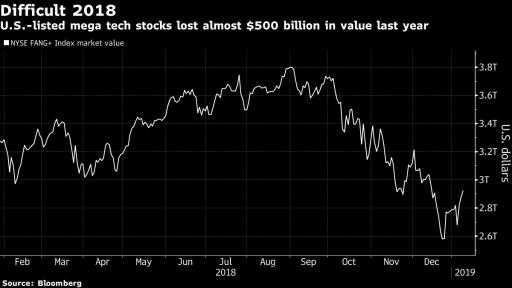

Technology stocks in the United States and China have suffered serious falls since last year, as tensions in trade have increased and worries about the world economy have overwhelmed the sentiment that hit the sector. The FANG + NYSE Index has shed more than half a trillion dollars by the end of January 2018.

The regulations have also had a negative impact on the sector after the technology giant Facebook has met enormous pressure, given the security concerns and privacy of users' personal information and the shocking arrest of Huawei's CFO.

Companies currently exist with the consequences and adapt to the degraded environment. Moore hopes the current trade talks will end with an agreement between China and the US to create new opportunities for co-operation between local technology companies.

Many fears are already appreciated in the emerging markets, and Moore has confirmed his positive opinion of the region's shares, especially the technology. Many high-tech companies have remained neglected by investors. Moore also confirmed his negative view of European stocks in 2019 because of the political challenges ahead and the slowdown in economic growth.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.