- Home

- >

- Daily Accents

- >

- BOE Could End Corporate-Bond Purchases as Soon as This Month

BOE Could End Corporate-Bond Purchases as Soon as This Month

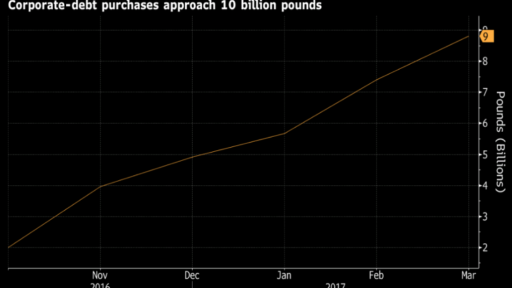

The Bank of England’s corporate-bond purchases, one of the stimulus measures announced after the Brexit vote, could conclude as early as this month as the program nears its 10-billion pound target.

After starting purchases in September, BOE officials have found investors more willing to sell company debt than they expected and are on track to meet their target within weeks.

While officials had initially given themselves a timescale of 18 months to complete the program, they did not set any sort of monthly goal to spread purchases evenly across that period and are happy to wind up operations earlier, according to policy maker Gertjan Vlieghe.

“The default position is that when we’ve accumulated the stock, that’s it,” Vlieghe said in an interview in London on Wednesday.

“At the prices we offered, we received bonds at a faster clip than we thought,”

The BOE is buying investment-grade sterling notes issued by U.K. companies or by overseas businesses with significant operations in the country. The announcement of the program in August helped spur new issuance as companies rushed to lock in cheap borrowing costs.

“With the Bank of England’s quantitative easing limit fast approaching, we expect greater volatility in the second quarter”

in the corporate bond market, said Jonathan Platt, head of fixed income at Royal London Asset Management. “We expect to see some manner of sell-off in high-profile bonds where prices have been boosted by the quantitative easing program.”

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.