- Home

- >

- Great Traders

- >

- Bond Guru Who Called Last Bear Market 40 Years Ago Says Go Long

Bond Guru Who Called Last Bear Market 40 Years Ago Says Go Long

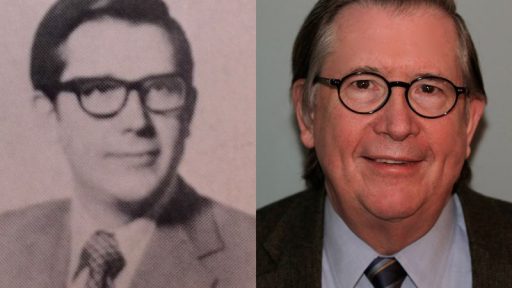

Lacy Hunt has lived through something the lion’s share of Wall Street hasn’t experienced.

As a young bond manager coming of age during the Great Inflation and Richard Nixon’s wage and price controls, Hunt saw the bear market in bonds coming in the late 1970s, and says he made a fortune for his clients.

Today, as hints of inflation start to bubble and calling the next bear market becomes the industry’s favorite pastime, Hoisington Investment Management’s Hunt shrugs it off and says “it’s just more of the same.” Using an out of fashion metric known as the velocity of money, the Austin, Texas-based economist says he’s convinced the rout since the election of Donald Trump is just a bump in the road for an extended rally.

The velocity is the rate at which money circulates in the economy and is usually measured as a ratio of nominal gross domestic product over the total supply. In other words, it measures how well an economy is able to generate transactions, and in turn growth, with an incremental increase of money in the financial system.

The problem is money velocity in the U.S. (as measured by M2) has fallen to a record-low of 1.44, meaning every dollar spent circulates only 1.44 times in the economy, down from over 2 times at the peak in 1997. To Hunt and other adherents, that shows even after years of unprecedented money printing by the Federal Reserve, inflation will remain subdued and elusive, largely because the private sector has chosen to hoard, and not spend, the money in the years after the financial crisis.

"When debt is at high levels and increasingly counterproductive, the most important lesson of economic history is that the velocity of money falls," said Hunt

The $314 million Wasatch-Hoisington U.S. Treasury fund gives reason to listen to Hunt. The fund has beat over 90 percent of peers in the past three and five years, though it’s down 0.7 percent since the start of the year.

Hunt isn’t the only one seeing the record-low pace as an ominous sign.

The fact that money velocity declined rapidly during years of near-zero interest rates may signal aggressive monetary easing actually led to deflation instead of inflation

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.