- Home

- >

- Daily Accents

- >

- Bond traders face reckoning if CPI data show inflation comeback

Bond traders face reckoning if CPI data show inflation comeback

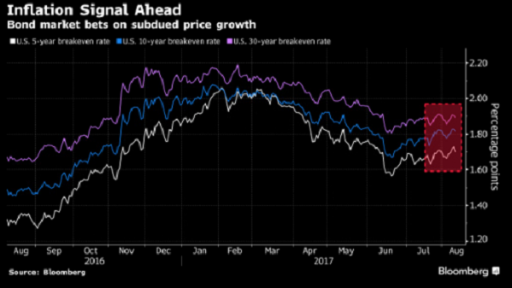

Treasury yields may climb from a six-week low if Friday’s U.S. consumer price data merely meet expectations, as the market is on high-alert for evidence that inflation is heating up and supporting the Federal Reserve’s case for higher interest rates.

Two Fed officials called subdued inflation a problem in comments Monday, heightening traders’ sensitivity to this week’s release. The stakes may be even higher, and the snap-back in yields more severe, after haven-buying spurred by escalating tension between the U.S. and North Korea. Yet if the data disappoint, there’s now less room for Treasuries to extend a rally with 10-year yields at 2.2 percent, not far above this year’s lows.

The consumer price index probably rose at a 1.8 percent annual pace in July, quickening from a 1.6 percent clip in June, a Bloomberg survey shows. The index fell the past four months, fueling skepticism about the Fed’s claim that stubbornly low inflation is transitory and that tighter policy would be appropriate. Weaker-than-forecast producer price data Thursday didn’t help the central bank’s case.

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.