- Home

- >

- FX Daily Forecasts

- >

- Brexit and Italian budged will move the FX market

Brexit and Italian budged will move the FX market

After the start of the European interbank market, the euro and pounds are the worst performed currencies of the day. GBP fails to escape the concerns that come from Brexit, as Teresa May will face a tough task of attracting parliament with her proposal.

In addition to the problems stemming from Brexit, the EUR has its own problems in the face of the Italian budget debt crisis, which is expected to deepen by the end of the week. Later today and tomorrow we expect the Italian government to propose a revised budget proposal for 2019. Expectations are that the revised budget will not appeal to the European Commission, which in turn will worsen the results of the EUR/USD bulls.

Let's look at the main currency pairs - EUR/USD and GBP/USD

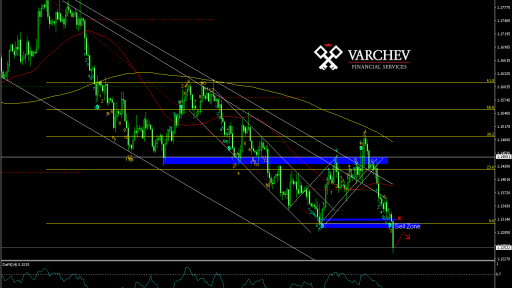

1. EUR/USD - technical view

At first glance, the EUR/USD proved to be in a free fall situation after testing a key area of support. The breakthrough brought the price to the sword territory, with the next strong support zone away from current prices - 1.1100. The trend is undoubtedly short, and the positioning should be a slight upward adjustment.

Charts:

2. GBP/USD - technical view

The pound is also in a free fall and does not give any indication of a possible upward adjustment. Current levels do not provide a good input, and Theresa May's simple promises make big investors run away from the pound. The first zone of support is far from current prices around 1.2700. Positioning should be after the formation of a good trending confirmation figure, such as a triangle or a flag. However, we can expect later this week and after normalization the pair's volatility.

Charts:

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.