- Home

- >

- Daily Accents

- >

- Brexit bill and what at the possibilities before UK

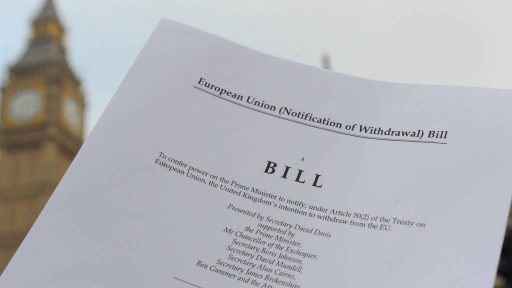

Brexit bill and what at the possibilities before UK

1. Soft/Hard Brexit

The meaning of both words is quite subjective, according to an EU official who is familiar with the Brexit process. But their basic and most important difference is that a hard Brexit means the U.K. will not keep its access to the single market.

2.Single Market

It's an area where member states buy and sell goods without tariffs. They all share the same rules for all products and services. But, in exchange, members need to respect the four fundamental freedoms – of people, goods, services and capital.A country can belong to the single market without being a member of the European Union. This is the case of Norway and Iceland [this is also known as the Norway Model].

3. The Norway Model

Norway has access to the single market but as a result it also contributes to the EU's budget and accepts the jurisdiction of the European Court of Justice. Brexiteers oppose the jurisdiction of the court and complain the U.K. is paying too much into the European budget in comparison to how much cash it gets from there.

4. Customs Union

This means that countries agree to apply the same tariffs to goods from outside the European Union, which makes their shipping from one country to the other much easier and quicker. Members do not negotiate trade agreements with other countries.A customs union also means some contributions to the EU budget and a few regulations from the ECJ. However, in the specific case of the U.K. it would allow the border between Northern Ireland and Ireland to remain open.

5. The Turkey Model

Turkey is a member of the customs union. As such it doesn't have a say in how tariffs are imposed to external goods but it has to apply them nonetheless.6.Switzerland has a free trade agreement with the EU and access to the single market, but not for its banking services. It pays into several EU projects and it also has to respect free movement of people.

7. Free Trade Area

This is what the U.K. seems to be pushing for by negotiating a new trade deal with the EU and thus creating a free trade area with it.However, negotiations usually drag on for years and it would likely mean border controls between Ireland and Northern Ireland.

8. European Court of Justice

The court deals with disputes between parties and ensures that European law is interpreted and applied in the same way in every member state.

9. Brexit bill

The U.K. will have to pay a bill for leaving the European Union, but according to the EU's negotiator this "is not a punishment". The money will be used to pay for projects that already received EU approval and other items such as benefits granted to U.K. citizens working in European institutions.

The methodology for the exit bill will be agreed with the U.K. during the upcoming negotiations, but some initial figures reported by the media pointed to as much as 100 billion euros.

10. Brexit proceedings

The EU wants to discuss how the U.K. will leave (the so-called divorce process) and then it will talk about their future cooperation. On the other hand, the U.K. wants to talk about both things at the same time.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.