- Home

- >

- Daily Accents

- >

- Brexit negotiators is away from a decision on a trade deal, how to take advantage of this?

Brexit negotiators is away from a decision on a trade deal, how to take advantage of this?

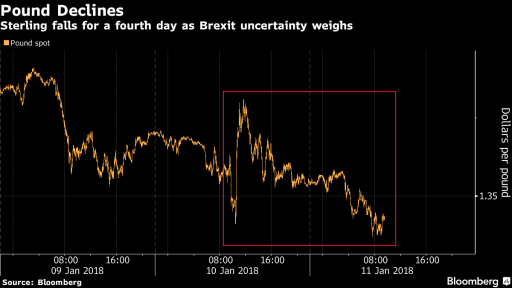

The pound declines for the fourth consecutive day after Philip Hammond called on the EU to clarify exactly what it wants to have with Britain. On the EU side, however, the desire to negotiate a trade deal is getting smaller. EU chief negotiator Michel Barnier argued that the UK trade deal would be fairly limited to European markets, despite the UK's full access requests.

The sterling gained almost 10% against the dollar in 2017, but most market participants claim that the strength of the currency has reached its peak. The average value expected by big banks by the end of the year for GBP/USD is slightly above 1.3500.

What to expect?

Given the slow but sure progress of the negotiations, the current shocks will affect short-term, giving us good levels of long-term positioning. The bulk of the goods on the island are European production and the termination of trade would result in serious losses for both sides. Therefore, we believe that the EU will step down from a firm standpoint and support a trade deal far different from what negotiators are now willing to do. Given the temporary bargaining difficulties, we expect a deeper GBP correction, with levels of 1.3300 eligible for a new long-term add-on.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Bloomberg: Pound Falls Fourth Day with Brexit Divisions Seem Far From Healing

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.