- Home

- >

- Fundamental Analysis

- >

- BREXIT Update – Expect tough months for GBP and FTSE100

BREXIT Update - Expect tough months for GBP and FTSE100

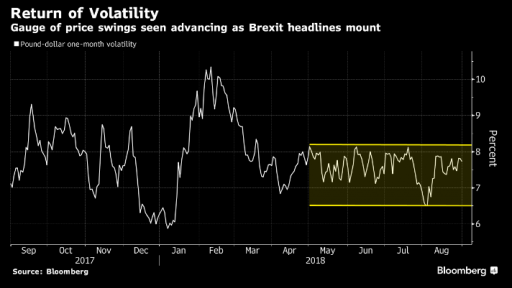

The next few months will be tough for GBP traders, as both countries, the EU and the UK continue to warn that Hard Brexit is ahead. This has started to excite the traders, and from now the sterling will be increasingly sensitive to the titles associated with Brexit.

What is the taboo theme in front of all retailers, and not just how much the market has accumulated Hard Brexit. While traders believe that the lack of a deal would be detrimental to the British economy, I expect GBP to remain under pressure. Undoubtedly, the GBP is in fashion and a lot of traders have focused on it, but I think it's good to pay attention to the FTSE100, which is trading at relatively high levels and will provide the best opportunity for shortening the situation that UK left the EU without a deal. Despite the bad prospects for UK, I think traders have not yet accumulated The Worst Case Scenario in the FTSE100 price, and in eventual Hard Brexit I expect massive sales of the British benchmark. Still, the pound is already down, and the real losers at Hard Brexit will be British companies.

Technical View - FTSE100 - Daily

Still the main trend is still growing, but during the last trading session the price of the index passed a key level of support from two previous bottles and 200SMA. At present, the price is hanging "in nothingness" and weighing the foundation, a test of the basic diagonal of the upward trend remains the most likely scenario. Sequential counts down 3 from the possible 13 - Downward Impulse is in an early stage.

Brexit Calendar - What to Expect From Here On!

- 18 October 2018 - Key Summit of the EU. Both sides hope to reach an agreement on future relations to give time to the British Parliament and EU members to ratify the Brexit deal.

- December 13, 2018 - If the deal is not completed by October, it is the last date on which the two sides can reach an agreement.

- March 29, 2019 - Whether we have a trade deal or not, Brexit will happen on Friday, March 29, 2019. at 23:00.

- 31 December 2020 - If everything goes according to plan, the transitional period will continue until midnight on that date.

The real event on which we need to focus is the likely summit in November (postponing that on 18 October) as this will be the final practical time for a final agreement and will be ratified by the national parliaments of all the Member States, EU member states before March 2019. It is then that you expect the biggest action in GBP and FTSE100.

As for the GBP/USD Volatility Index, traders still do not expect strong volatility over the next 30 days, but the outlook remains on the rise.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.