- Home

- >

- Opportunities for profit today

- >

- Bullish bond market under question, how do we benefit?

Bullish bond market under question, how do we benefit?

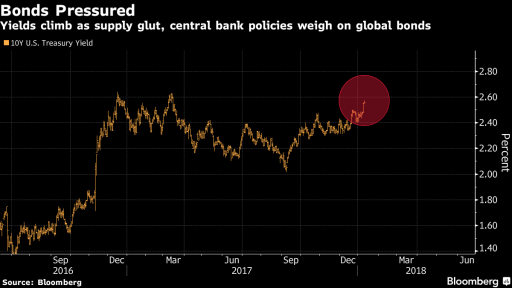

After several of Wall Street big names have warned that the debt market is facing a reversal, many traders are fine to think about how to position themselves to take advantage of the upcoming changes.

European and US government securities remain relatively calm before the sale of bonds worth nearly $30 billion. from USA, Germany, Italy and Portugal. Earlier today, Bill Gross said that after more than 25 years of growth in the bond market, bears take time to take the lead.

How do we benefit from this?

Perhaps the best option is to target the ETF, tracking yields on 7 to 10-year bonds, such as the iShares 7-10 Year Treasury Bond ETF (IEF.US). Technically, ETF-a has broken the long-term trend starting in 2007 and is currently in a new, downward channel that, given the mood of the market, is likely to continue. In the last few days, the price has hit a strong level of support and is currently making a strong downward impulse. 50SMA and 200SMA are bruised - also negative for the price. CCI50, indicating the direction of long-term traffic, is also on a negative territory confirming traffic.

The strongly negative moods of the Bond Market give us a good opportunity to position Short with a short stop. Input from current levels is reached with SL at levels above the upper diagonal of the channel, above 106.50. The first level of support traders should pay attention to is the range between 103 and 103.50, as a breakthrough in the downward direction will greatly enhance the negative sentiment, and it is very likely that we will observe collapse in the bond market.

Source: Bloomberg Pro Terminal

Jr Trader Petar Milanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.