- Home

- >

- Daily Accents

- >

- Bulls are going all-in on the Biotech rally

Bulls are going all-in on the Biotech rally

Traders can’t get enough of biotech shares, whose advance this week has made them the top performers among U.S. equities in June.

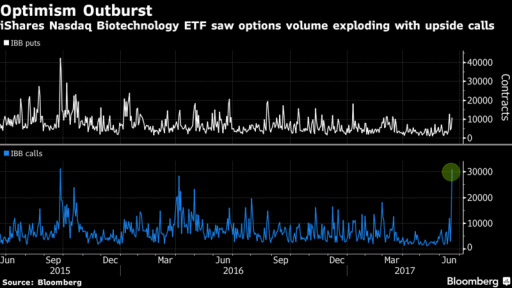

Up almost 7 percent in three days, the iShares Nasdaq Biotechnology exchange-traded fund has been the site of frenzied options trading, with more than 41,000 contracts changing hands on Tuesday alone. Almost three calls have traded for every put that bets on a decline. A ratio that lopsided was last seen in July 2005, data compiled by Bloomberg show.

Call volume on the $8.6 billion fund was three times the 20-day average on Wednesday.

Clinical breakthroughs and easing political pressure fuel investor appetite for biotech stocks that plunged the most in the S&P 500 Index last year amid concern over industry regulation and drug pricing.

After threatening to give government more negotiating power over drug costs and accusing manufacturers of “getting away with murder,” President Donald Trump is expected to settle for an executive order that will be “constructive” and supported by the industry, according to Goldman Sachs Group Inc. health-care analysts.

Hopes are also high that deal activity will also pick up after a few small and midcap firms including Clovis Oncology Inc. released promising data on new therapies. More transactions could help biotech giants such as Gilead Sciences Inc. boost growth at a time when sales are slowing.

It’s not just biotech shares that are rallying. Health-care stocks in general have been the best performers this quarter. A 6.7 percent rally has taken away most of their valuation discount to the S&P 500 Index The stocks trade at an average 16.4 times projected 12-month earnings, compared with 17.7 for the benchmark, the narrowest discount in more than 10 months.

And the sector may have more room to run, according to Miller Tabak & Co. equity strategist Matt Maley. As investors rotate out of technology stocks, they’re continuing to turn more defensive areas, including health care and utilities, he said.

“As things get a little expensive, it’s usually more nerve-wrecking for investors when it’s growth stocks getting expensive than defensive stocks,” Maley said by phone. “There is a potential for a further advance in biotech and health-care stocks in general.”

Source: Bloomberg

Trader Senan Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.