- Home

- >

- Stocks Daily Forecasts

- >

- Buy-the-Dip Is Failing in S&P 500, Evoking Bear Market Memories

Buy-the-Dip Is Failing in S&P 500, Evoking Bear Market Memories

For the first time in the last decade, buy-the-dip is not working on the shares.

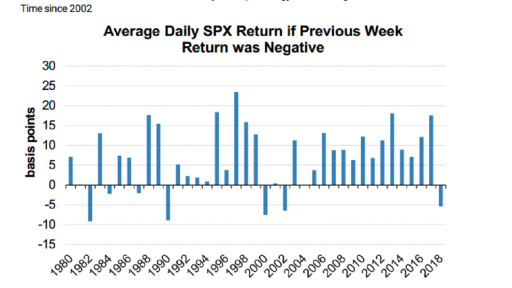

As a way to measure this, Morgan Stanley surveyed the S & P 500's five-day declines this year and found that on average, the 6th day also generated a loss of 0.05%. While this loss is small, it is a big difference from the past 16 years, when these declines always gave way to profits.

This happened again on Monday, when the index fell 0.9%, after a week of losses.

This pattern reflects the change in investor psychology, which may not be apparent if you judge the market at the level of the index or the Wall Street forecast. Despite the two adjustments of 10%, the S & P 500 is still in positive territory for the year. And 18 out of 25 strategists tracked by Bloomberg predicted the index would end 2018 over the record peak of 2,930.75 in September.

However, the investor sentiment, measured by some analysts, has reached levels recently seen by market crashes in the past. After 1980, all periods lacking the Buy-the-Dip attitude included bear markets: 1982, 1990, 2000 and 2002. For Mike Wilson, chief US equity strategist at Morgan Stanley, this is a sign that markets have overcome a threat - economic growth, corporate earnings, or other.

"While 2018 is certainly not a year marked by a recession, the markets clearly say bad news comes," Wilson said. "Our view is that the markets suffer a recession in revenues and a sharp decline in economic growth."

With an annual forecast of 2,750 for the S & P 500, Wilson is the most bearish strategist on Wall Street. Calling it a "Rolling Bear Market," he predicts that high interest rates and a less synchronized global economic expansion will hit financial markets in a price pattern that will, in particular, hurt leaders such as the technology sector.

Computer and software makers led the sale in October, posting profits that nearly doubled the market in the first nine months of the year. With the last sale, over 40% of the S & P 500 fell by at least 20% of its recent peaks, which is itself a bear market definition.

Source: Bloomberg Finance L.P.

Chart: Used with permission from Bloomberg Finance L.P.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.