- Home

- >

- Daily Accents

- >

- Buybacks of shares can’t stop the mass selling

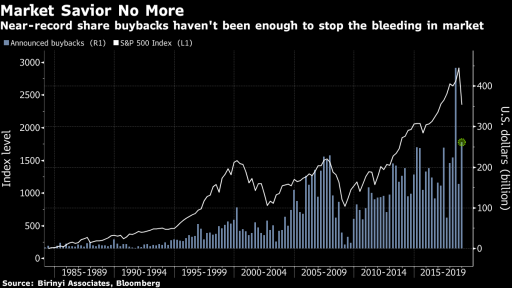

Buybacks of shares can't stop the mass selling

It seems that corporate America, which has traditionally been an exclusive supporter of stock trading, has reached its limit in its attempt to keep the bulls on the surface.

In the last quarter of this year, when US companies announced plans to spend more on buy-back programs, we saw a 15% decline in the S & P500. The strongest fall in the index since 2008 and the indices are on the brink of entering the bear market.

It seems that redemption has become useless. Critics of this move say that companies will spend billions of dollars in vain, too, that, in general, the redemption of shares has little effect on their prices. Here, of course, we can draw conclusions, but whatever it is, the lack of efficiency of redemption is evidence of the strength of the bears when they come into action. Since early October, US companies have earmarked $ 260 billion for future share buyouts.

The inefficiency of this tactic arises from the fact that there has been a change in the mood of investors, regardless of the prospects for economic growth and the corporate profits next year. In the short term, it is not possible to rely on tactics to work and companies to "save" the market.

This is how a balloon blows. It turns out that corporations have a huge appetite for stocks that overshadows investors as the largest source of demand for US stocks.

In February, the market reached its bottom when Goldman reported a serious influx of redemption orders. This time, however, the orders, even at record levels, failed to put a brake on the collapse. Since its peak in September, the US stock markets have shed $ 7 trillion of their value.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.