- Home

- >

- Daily Accents

- >

- Buying Nvidia Now Is Like Getting Intel Way Back in 1993, Jim Cramer Says

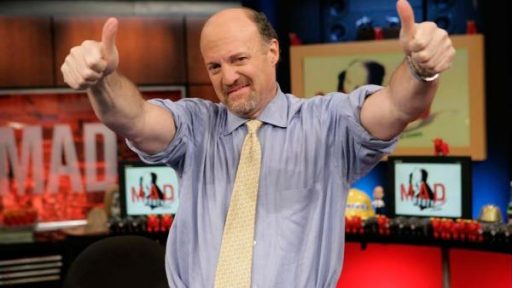

Buying Nvidia Now Is Like Getting Intel Way Back in 1993, Jim Cramer Says

Jim Cramer thinks Nvidia "still has room to run" -- and looks lot like Intel did back in the early 1990s before a multiyear rally that took that stock up some 17-fold.

"Take a look at where Intel was in '93, '94 [and] think like that, OK?" Cramer said during an exclusive conference call with members of his Action Alerts PLUS club for investors. "Go back and look at the way that Intel ran all through the '90s. This is an Intel-like story."

Nvidia shares have been hot recently given the fact that many cryptocurrency "miners" favor the company's chips. The stock rose as much as 6.2% Monday to a $191.20

"Nvidia's products set the standard in graphics, in artificial intelligence and in deep learning," he said. "Talk about the three trends that we have to be most involved in. Their cutting-edge processors are the industry's leader because of advanced software language, and are used in gaming, autonomous driving, the cloud ... and yes, cryptocurrency mining, just to name a few."

In the chart below, we can see the company's revenue / debt ratio. It makes it clear that revenue is on the rise and the debt is down, which is positive for the stock price.

The following graph shows EPS of the company. We see that it is also rising. This is one of the most important indicators for investors and is very important for the company's stock price.

Source: Bloomberg Pro Terminal

Junior Trader Stefan Panteleev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.