- Home

- >

- Daily Accents

- >

- By how long will markets ignore the Chinese economy

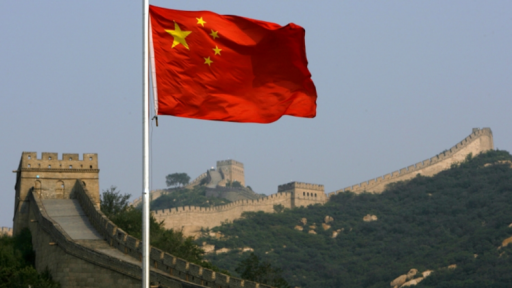

By how long will markets ignore the Chinese economy

The situation with Saudi Arabia and the focus on the Fed have shifted China out of the spotlight and worries over the Asian economy. And the situation with China's economy is not very promising.

The Chinese government has announced that sustaining 6% growth is already extremely difficult. Chinese industrial production in August posted a growth of 4.4% from the expected 5.2%. Retail sales in August came out 7.5% against the expected 7.9%.

I do not think that the markets are paying enough attention to the signs China has been sending since the beginning of this week, which may be a sign that the markets have reached a strong level of confidence. The PBOC does not yet show strong signs of easing credit policy.

Trading prospects are extremely tempting at the moment for risk sentiment, but it is unlikely to be a game changer for the slowing Chinese economy. Local consumption is slowing, which will continue to "eat" from global economic growth.

Markets may be scattered right now because of news about oil and central banks, as well as optimism about a trade deal. However, do not expect this to continue for too long. The more markets ignore these breakthroughs in the economy, the faster the ship will fill, which will surprise the markets at the most unexpected moment.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.