- Home

- >

- Daily Accents

- >

- Carl Icahn: I think markets are overpriced, earnings are misstated

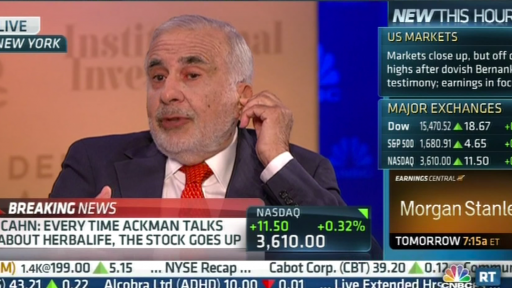

Carl Icahn: I think markets are overpriced, earnings are misstated

Markets look "way overpriced" and many investors have put themselves in "dangerous" positions, activist investor Carl Icahn told CNBC on Wednesday.

"The public in my opinion is going to get really hurt," he said on "Fast Money: Halftime Report." "This market is in very dangerous territory."

Icahn stressed many of the points he made in a video posted this week titled "Danger Ahead." He said stocks could see a tough run amid the Federal Reserve's near-zero interest rate policy and headwinds like financial engineering for the sake of earnings growth.

"I think earnings are misstated and sort of a complete mirage," he said Wednesday.

In the video, Icahn also warns about potential problems caused by tax loopholes, stock buybacks and liquidity in the high-yield bond market. Amid his concerns, Icahn said he has hedged his investments much more.

Icahn stressed, though, that a collapse similar to the one that took place in 2008 seems unlikely.

The billionaire investor has often touted tech giant Apple and criticized the high-yield debt market, which he has long and short interests, respectively. He reiterated previous statements that Wall Street does not fully appreciate Apple and he has considered buying more of the stock.

"I think Apple is still ridiculously underpriced," Icahn said Wednesday.

Icahn also responded to criticism that his dire warnings could benefit his investment positions. He contended that his statements do not always move the markets he discusses.

Despite his pessimistic outlook, Icahn recently raised his stake in battered natural gas company Cheniere Energy to 11.43 percent. He also built up a huge position in crushed mining company, Freeport-McMoRan.

Icahn said buying the stocks at a cheap price provides chances for long-term upside.

"These are great opportunities I think. But here you have to be extremely careful if you're the average investor," he said.

He added that people are "right to expect" that he would push Freeport for structural changes.

Freeport and Cheniere shares had fallen 60 and 31 percent this year, respectively, as of Tuesday's close.

Varchev Traders

Varchev Traders If you think, we can improve that section,

please comment. Your oppinion is imortant for us.