- Home

- >

- Commodities Daily Forecasts

- >

- Central banks with a record interest in gold

Central banks with a record interest in gold

The amount of gold purchased by central banks in 2018 has reached a new record for the second consecutive year, according to the World Gold Council (WGC).

Net banks bought 651.5 metric tons of gold in 2018, 74% more than in 2017 when 375 tonnes were purchased. According to the WGC, central banks already have nearly 34,000 tons of gold. The Federal Reserve has the largest share.

Excessive geopolitical risks and economic uncertainty throughout the year have prompted central banks to diversify their reserves in safe and liquid assets. The Central Bank of Turkey and Russia have the strongest increases in their reserves followed by Kazakhstan, India, Iraq, Poland and Hungary. The central banks that have unloaded their gold reserves are Australia, Germany, Sri Lanka, Indonesia and Ukraine.

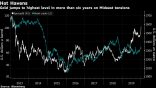

The strong demand for gold since the end of last year, which continues to date, stems from the fall of the Fed and the weakening of the US dollar. Breakthrough in the resistance area of around $ 1296 per troy ounce unleashed new purchases, resulting in new tops reaching over $ 1,300. Reaching 78.6 Fibo (blue) and the top line of the trend, the price encounters a difficulty that can form scenarios for a mid-term price correction.

Източник: CNBC

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.