- Home

- >

- FX Daily Forecasts

- >

- CHF the downturn is likely to continue at least in the near future

CHF the downturn is likely to continue at least in the near future

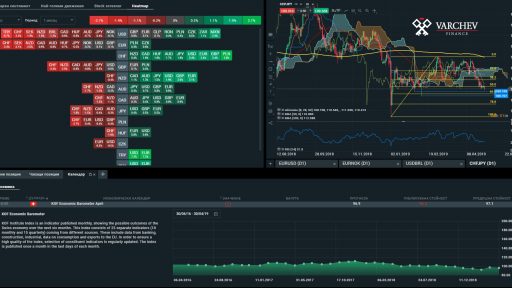

The KOF Economic Barometer data from earlier today will not have a direct impact on the Swiss franc. These economic data do not cause much volatility but provide a longer-term guideline for the strength of the Swiss economy. Despite the increase last month, the current values are glowing red again, which should make us think that CHF remains for the state of the economy. This fundamentally determines the expectation of a further decline and a further decline in all crosses at least in a short-term and perhaps medium-term plan (week to month).

Additional negativism for CHF also plays the positive sentiment of stock markets, as the Swiss currency usually being used for safe heaven by investors.

Technically, even against the weak Japanese yen, CHF is still not in oversold area according to the RSI (14), and the price is likely to test the bottom of the fx flash crash-a about 106.90 at CHFJPY. The Ichimoku cloud, SMA50 and SMA200 also support the negative CHF expectations. Today is the last day of the month and we can expect at least a small correction before positioning, with the performance of the CHF at all crosses of the last month showing negativism.

Trader Nikolay Georgiev

Trader Nikolay Georgiev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.