- Home

- >

- Daily Accents

- >

- CHF Volatility May Top JPY First Time Since 2015 SNB Turbulence

CHF Volatility May Top JPY First Time Since 2015 SNB Turbulence

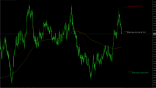

The volatility spread between the two most favored haven currencies looks set to be reversed. Swings in the franc may soon surpass those in the yen for the first time since April 2015, with the Swiss currency becoming more sensitive of late to geopolitical risks and the euro-franc spot rate breaking out of a two-year range.

With one-month realized volatility in EUR/CHF at highest level since July 2016 and spot rising above 1.15 for first time since SNB removed the 1.20 floor, implied volatility remains bid

One-month implied is little changed Wednesday at 8.25%, after touching an almost four-month high of 8.80% on Monday; EUR/JPY on the tenor trades at 8.83%, as the spread between the havens declines to the narrowest in two years. Positioning has played a large part in the spread’s latest move south as EUR/CHF had risen by nearly 5% within a period of nine trading days and geopolitical concerns prompted investors to take profit.

Fact remains that the franc has reemerged as a haven, especially as Japan’s proximity to the Korean peninsula has some analysts claiming the Swiss currency as the preferred one to hold in case of Korea tensions

EUR/CHF volatility has consistently exceeded EUR/JPY only during the aftermath of the SNB’s FX floor removal in 2015 and through the euro-area crisis in 2011; while a structural shift may not be on the cards, the spread could visit negative territory, especially if EUR/CHF makes an attempt toward 1.20

The market is short gamma above 1.16, according to a Europe- based trader; could make case for investors chasing the market higher.

Source: Bloomberg Pro Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.