- Home

- >

- Market Rumours

- >

- Citi: Canary Wharf already price in Hard Brexit

Citi: Canary Wharf already price in Hard Brexit

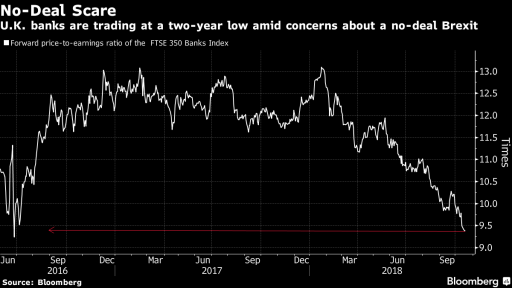

As the world has turned its attention to Brussels to see if there will be a Brexit deal, the investors in the bank shares of the Kingdom do not wait. They already hedge their positions with a possible Worst Case Scenario, Citi analysts say.

Although Citi still thinks Soft Brexit as a more likely scenario, a possible failure would have hit the profits of banks at the rate of -25%.

The FTSE350 Banks index is trading close to a 2-year low, due to slower growth, a weaker GBP and political instability in the country that scared investors into British creditors.

According to Citi, Lloyds Banking Group and Barclays Bank Plc can face the biggest risk due to their larger unsecured credit exposures. The failure of the deal will also likely mean that interest rates will remain lower for a longer period of time, which will further weaken bank profits.

Earlier today, Therese May spokesman commented that the UK would be deferred by the end of autumn. So far, one thing is clear, the meeting between the UK and the EU will not be marked by a clear agreement.

"We are working incredibly hard to make progress as quickly as possible and to ensure that there is time for the necessary legislation," said the UK negotiating team.

The GBP is currently under pressure below the weekly peak, with the general expectation that purchases will increase if the negotiators today and on both sides show willingness to reach an agreement.

Source: Bloomberg Finance L.P.

Charts: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.