- Home

- >

- Daily Accents

- >

- Citigroup Beats JPMorgan for FX Trading Crown as Margin Narrows

Citigroup Beats JPMorgan for FX Trading Crown as Margin Narrows

- UBS is No. 3 in annual Euromoney ranking released Thursday

- First three slots are unchanged from last year’s results

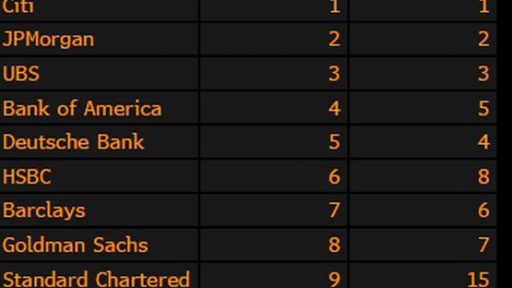

Citigroup Inc. held off JPMorgan Chase & Co. to retain its spot as the world’s largest currency trader by market share, earning the title for the fourth straight year, according to a Euromoney Institutional Investor Plc survey.

Although the top three slots were unchanged from last year, the margins separating the banks narrowed. Citigroup took a 10.7 percent share, edging out JPMorgan at 10.3 percent as UBS Group AG followed with 7.6 percent. Last year, the gap between winner and second place was about 4 percentage points.

The results showed that the biggest investment banks are ceding share to smaller market makers -- both banks and non-banks: The top five banks this year controlled 41 percent of trading, down from around 45 percent last year. Seven non-bank liquidity providers made it into the top 50, Euromoney said. XTX Markets, a London-based computerized trading firm that made a splash last year by vaulting over major banks to place 9th, was 12th this time.

"We continue to see a consolidation at the top of the industry, it’s difficult to differentiate yourself," said Josh Friedlander, a managing editor for Euromoney data.

With global volume declining 1.9 percent, the latest ranking reflects investment banks’ struggle to profit from currency trading in the face of post-crisis regulations and competition from new market makers. Diminished turbulence in the $5.1 trillion-a-day market doesn’t help either, as volatility has declined to the lowest level since 2014 following a brief revival after the U.S. election.

During the first quarter, revenue generated by trading major currencies fell to the lowest since at least 2006, according to research firm Coalition, which tracks the performance of the world’s 12 biggest investment banks

Source: Bloomberg Pro Terminal

Senan Fuchedzhiev - Trader

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.