- Home

- >

- Stocks Daily Forecasts

- >

- Clouds over the automotive sector

Clouds over the automotive sector

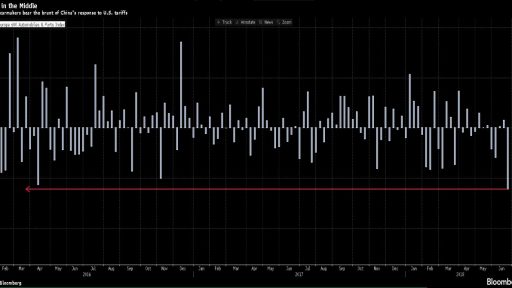

While market analysts are still finding it difficult to determine whether the US and China are in a trade war, traders have accumulated the negative consequences for the automotive sector. This week was the worst for the automotive sector since January 2016. here. Less than 48 hours ago, Daimler AG drastically reduced its profit forecast, highlighting the deteriorating US-China trade relationship. Dozens of negativity added the Daimler emissions scandal, as well as the arrest of Audi CEO Rupert Stadler.

Is it good to invest in the automotive sector?

The answer is yes and no. In the short term, prospects are negative, but in the long run, market leaders such as Daimler, Volkswagen and BMW will be profitable. In the short run, there are three very serious factors that would limit the rise in stock prices in the automotive sector. First of all, there is trade relations between the US, China and Europe. Diesel scandals among premium brands also pull the sector down. We must also remember the colossal investments of companies aiming at the introduction of entirely new electric models or the transformation of existing ones with ICE into hybrids or fully electric cars. In the long run, as companies have a clear vision of how plans for electrification will be developed, we can expect stock price stabilization and a move to a rising trend.

Graphic: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.