- Home

- >

- Fundamental Analysis

- >

- Cognitive dissonance exists in the US stock market

Cognitive dissonance exists in the US stock market

Analysts at Goldman Sachs believe that investors and traders in the stock market act irrationally.

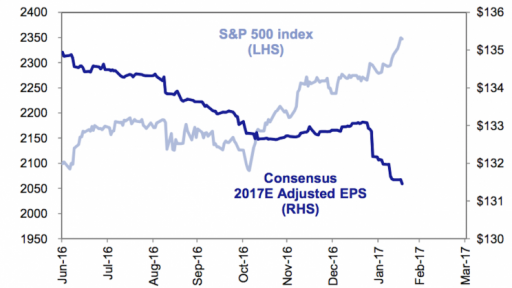

Since the election, S & P500 has gone up by 10%, while earnings reports were negative.

Income and expected earnings growth are the most important factor for equity prices in the long run. In short, however, profits and prices often diverge.

Largely rally in stocks after the election of Trump was due to promises to ease corporate taxes and regulation. Only bullish sentiment were mitigated due to insecurity about the global geopolitical environment and protectionist trade rhetoric Trump.

Side-sell analysts seem hesitant to potential reform of tax relief and deregulation, and their estimates are for increased political uncertainty. Positive revisions of the combined S & P500 assessments are rare - the last 33 years, consensus EPS estimates are revisirani up their base only six times.

Goldman Sachs analysts have made no secret about their cautious attitude toward the market. In a note outlining expectations for the S&P 500 in 2017, they argued “hope” would drive the index to 2,400 before “fear” takes over pulling the index back down to 2,300 by year-end.

On Friday, the S & P500 closed at 2351.

According to David Kostin, of Goldman Sachs, we are approaching the point of maximum optimism regarding policy initiatives and expect soon the investors to slow down their expectations for the potential growth of ESP for 2017 as they will face the reality that the increasing impact of tax reform will not happen until 2018.

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.