- Home

- >

- Daily Accents

- >

- Consequences of Powell’s statement: King Dollar dethroned, indexes with incredible bounce

Consequences of Powell's statement: King Dollar dethroned, indexes with incredible bounce

Today, the statement of Fed Chairman Jerome Powell was made. Here are the highlights:

- We do not have a clear path for interest rates

- The impact of interest rates is uncertain, it may take a year or more to feel

- The gradual lifting move was designed to balance the risk of excessive fast or slow interest rates

- Interest rates are still below historical standards

- We have enough arguments to support the US economy as strong

- We expect stable economic growth, low unemployment and near-end inflation

- We observe very carefully economic data

- We have anxiety about stepping up corporate lending, which may be a catalyst for economic slowdown

- We do not see a serious threat to stock markets

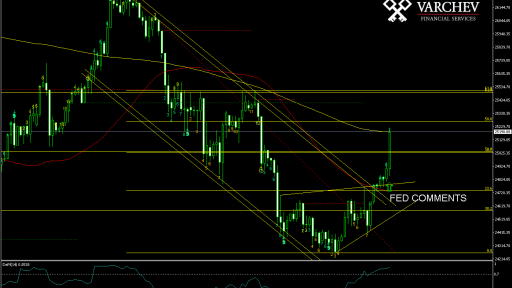

The US dollar reacted with a strong impulse down the commentary on the unclear path to monetary policy historically low interest rates. The indices and gold included strong upward movements as a result of Powell's more "dovish" mood.

EUR/USD H4

GOLD H4

DJIA H4

The complete comment: "While most FOMC players make their predictions on the basis of forecasting, there is no clear-cut and outlined path for our policy, and we will carefully observe what economic and financial data tell us."

Another key point: "We have therefore begun to raise interest rates gradually to levels that are more normal in a healthy economy, and interest rates are low compared to previous historical figures and remain below the level of what is considered a" neutral level "for the economy - neither sharply rising interest rates nor declining interest rates.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.