- Home

- >

- Cryptocurrencies / Algotrading

- >

- CREDIT SUISSE: Here’s how high-frequency trading has changed the stock market

CREDIT SUISSE: Here's how high-frequency trading has changed the stock market

The practice, which uses complex algorithms to analyze multiple markets and execute orders based on market conditions, has divided Wall Streeters into two camps: those who think the stock market has benefited from their existence, and those who argue to the contrary.

What's not in doubt, however, is their overall impact on the stock market.

"They’ve firmly established their place in the market ecosystem, primarily serving as a facilitator connecting buyers and sellers through time, but also frequently criticized in that role for being superfluous, or worse, predatory," Credit Suisse strategist Ana Avramovic said.

In a note, titled We’re All High Frequency Traders Now, Avramovic ran through four ways HFTs have impacted the market.

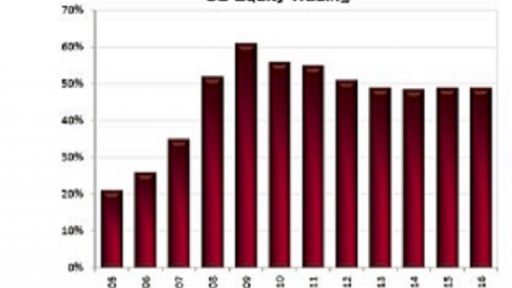

Higher trading volumes

Higher trading volumes are HFT's "largest, longest lasting, and most visible impact," according to Credit Suisse.

"We estimate that volume from money managers and investors, both active and passive, has remained fairly consistent for at least a decade (between about 3 and 4 billion shares per day)."

There are complaints that this activity isn't "real" activity, but rather that this increase is down to unnecessary trading, or is designed to take advantage of slower moving investors.

Bid-ask spreads for large cap stocks have tightened

A bid-ask spread is an important concept on Wall Street. It refers to the difference between the price at which someone wants to buy an asset (bid price), and the price at which the seller wants to sell that asset (ask price). The tighter the better, in theory. That suggests a concentrating of trading in the most liquid, biggest stocks.

There is more volatility in large cap stocks at the end of the trading day

Large-cap stocks and small-cap stocks also see the most volatility at different times of the day.

"At the beginning of the day, small caps tend to be more volatile as they take a bit longer to establish fair price," Credit Suisse said. "But, at the end of the day, they actually have slightly lower volatility than large caps."

There is more volatility in large cap stocks at the end of the trading day

High-frequency traders often seek to benefit from inefficiencies in the market, stepping in when something has moved too far.

As a result, "there are fewer instances of prices gapping in stocks that generally have a larger HFT presence," according to Credit Suisse. In other words, those stocks have fewer extreme up and down ticks.

"For several years going into 2009, when HFT hit its peak, the ratio of gaps in small caps to large caps remained around five gaps.

Source Business Insider

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.