- Home

- >

- Market Rumours

- >

- Credit Suisse: ” Nothing like that of a recession”

Credit Suisse: " Nothing like that of a recession"

Economic data looks nothing like that of a recession, according to Credit Suisse.

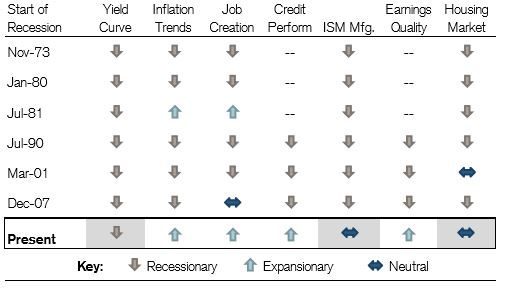

The firm created a “recession dashboard” in which the firm tracked the state of seven main economic indicators at the start of each recession dating back to 1973. In past recessions, most of the indicators were “recessionary” or “neutral,” while the current state of the economy is telling a different story.

“Key signals such as labor and credit trends remain quite healthy,” said Credit Suisse’s chief U.S. equity strategist, Jonathan Golub.

Last week, the U.S. bond yield curve inverted, a phenomenon that historically presages a recession. That was the only one of the seven major indicators Credit Suisse tracks to signal a downturn. In past recessions, indicators like inflation trends, job creation, credit performance, ISM manufacturing, earnings quality and the housing market were all showing weakness.

The labor market is strong with the total labor force hitting a record high of 163.4 million, according to the Labor Department’s July jobs report. And credit conditions have not deteriorated to recession levels.

Inflation and earnings quality are all “expansionary” indicators, according to Golub. Inflation is close to the Federal Reserve’s 2% target and in the second quarter, nearly 75% of S&P 500 companies that reported earnings so far beat analyst’s expectations.

To be sure, despite the recession scorecard looking optimistic, Golub said, “recessionary indicators are more mixed than they have been since the financial crisis.”

Manufacturing data, which is currently “neutral” on Golub’s dashboard, has deteriorated meaningfully, primarily outside of the U.S., he said.

Growth in the U.S. services sectors decelerated in July to its weakest level in three years as trade worries weighed on business orders and the outlook for the overall economy.

The housing market is also neutral as housing starts have dropped for three straight months.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.