- Home

- >

- Stocks Daily Forecasts

- >

- DAI.GR – Short after an activated Head and Shoulders

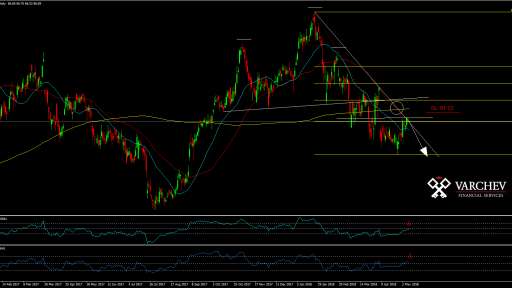

DAI.GR - Short after an activated Head and Shoulders

DAI.GR Our Expectations - Long-term rising trend, mid-term declining. Price reached horizontal and diagonal resistances. Opportunity for short positions with SL 67.53

Alternative scenario: If the price rises above the declining trend line and comes a successful test, we could look out for long positions after a confirmation from a price action signal.

Commentary: Trend-reversing formation of Head and Shoulders - breakaway and test of the neck line. Unsuccessful breach of the diagonal and horizontal resistances - the level coincides with 23.6 Fibo, measured from the declining movement, starting with the high on 24.01.2018 to the bottom on 25.04.2018. "Deadly Crossover" of 50/200 SMA - bearish signal. Test of the 50 SMA successful - the declining movement continues. CCI 50 is below 0. For a more precise entry we wait RSI 14 to cross 50 upside - down - both indicators in combination gives us the necessary price action signal for short selling.

Fundamental: In sharp contrast with energy stocks, which recovered and are now surging ahead on positive revisions, banks and autos are still well underwater vs. levels reached in late-January's market peak. For the cause, look to growth expectations. Bank top-line expansion is hard to generate in a low interest-rate environment, and autos face peaking developed-market sales at a time they are having to invest heavily on the transformational shift taking place in the industry.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.