- Home

- >

- FX Daily Forecasts

- >

- Supports and resistances for the major currency pairs, today 24.05.2017

Supports and resistances for the major currency pairs, today 24.05.2017

USD/JPY -- Reunites with ichimoku equilibrium line at 112.10 from where sell interest could reside; mind the 2.6b USD option expiry at 112

3rd resistance: 112.59, 100-DMA

2nd resistance: 112.37-40, 21-DMA, May 8 low

1st resistance: 112.10 ichimoku conversion line

Spot: 111.87

1st support: 111.63, 55-DMA

2nd support: 110.86, May 23 low

3rd support: 110.24, May 18 low

EUR/GBP -- Bulls overwhelmed at last Fibonacci level at 0.8676 but stay in charge

3rd resistance: 0.8697, pivot r2

2nd resistance: 0.8676, 76.4% Fibonacci of March/April

1st resistance: 0.8641, daily pivot

Spot: 0.8612

1st support: 0.8603, May 19 high

2nd support: 0.8569-61, May 19 low, 100-DMA

3rd support: 0.8524, May 18 low

EUR/USD -- Tuesday wobble does not detract bull focus on 1.1300 resistance

3rd resistance: 1.1268, May 23 high

2nd resistance: 1.1242, pivot r1

1st resistance: 1.1209, daily pivot

Spot: 1.1190

1st support: 1.1162-54, May 22 low, 19 mid open/close

price

2nd support: 1.1097, May 19 low

3rd support: 1.1076, May 18 low

AUD/USD -- Remains on course to test moving-average zone at 0.7532-36

3rd resistance: 0.7532-36, 55-DMA, 200-DMA

2nd resistance: 0.7517, May 23 high

1st resistance: 0.7487, daily pivot

Spot: 0.7465

1st support: 0.7435, May 22 low

2nd support: 0.7407, May 19 low

3rd support: 0.7389, May 17 low

GBP/USD -- Bulls remain in control; rising 21-DMA (1.2932) provides trailing risk line

3rd resistance: 1.3139, Sept. 14 low

2nd resistance: 1.3121, Sept. 22 high

1st resistance: 1.3048-59, May 18, Sept. 29 high

Spot: 1.2977

1st support: 1.2927, May 19 low

2nd support: 1.2900, May 18 low

3rd support: 1.2866, May 16 low

EUR/JPY -- Maintains offensive posture while above 21-DMA

3rd resistance: 126.47, April 28 2016 high

2nd resistance: 125.82, May 16 high

1st resistance: 125.40, May 17 high

Spot: 125.15

1st support: 124.57, May 23 low

2nd support: 124.11, May 18 high

3rd support: 123.58, 21-DMA

USD/CHF -- Reacting to oversold momentum setup

3rd resistance: 0.9848, May 16 low

2nd resistance: 0.9824, May 17 mid open/close price

1st resistance: 0.9805, May 19 high

Spot: 0.9750

1st support: 0.9702, May 23 low

2nd support: 0.9692, May 22 low

3rd support: 0.9550, Nov. 9 low

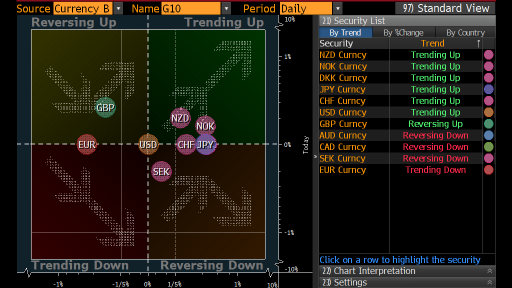

Source: Bloomberg Pro Terminal

Jr Trader Alexander Kumanov

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.