- Home

- >

- Great Traders

- >

- David Tepper withdraw from the business

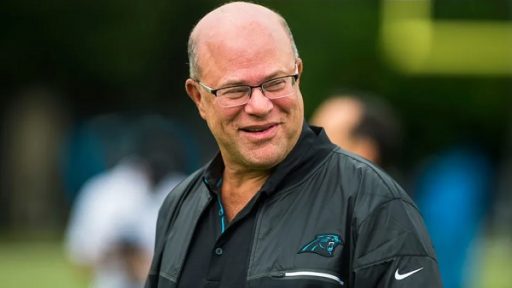

David Tepper withdraw from the business

Appaloosa Management manager David Tepper is considering returning the hedge fund’s capital to investors and converting it to a family office, but that he has yet to set a specific timetable on returning money.

That Tepper was mulling the capital return was first reported by the Wall Street Journal and Bloomberg News. Sources also told the Journal that the fund’s employees have been instructed that Tepper’s investment business is transitioning, with some interviewing with other investment firms.

Those sources also said that the longtime investor hopes to concentrate his efforts on building the Carolina Panthers franchise.

The shift would represent a new era for the hedge fund leader, who founded Appaloosa in 1993. The Pittsburgh native made a name for himself during the financial crisis through investments in depressed bank securities among other bold calls over the last 26 years. Appaloosa managed about $14 billion according to recent estimates.

The fund has posted annualized returns of more than 25% on average since Appaloosa’s start, sources confirmed to the Journal.

But signs Tepper could be looking for a different type of investment came last year, when the National Football League announced that the hedge fund manager had reached a deal to buy the Panthers franchise for a record $2.2 billion.

Sports teams have historically proven solid investments, as the value of the average NFL franchise more than doubled in the decade from 2007 to 2017, climbing to $2.52 billion from $957 million. At the time of Tepper’s deal was announced in 2018, the price tag was the highest ever paid for a football franchise and dwarfing the $1.4 billion the Pegula family paid for the Buffalo Bills back in 2014.

Source: CNBC

Trader Georgi Bozhidarov

Trader Georgi Bozhidarov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.