- Home

- >

- Stocks Daily Forecasts

- >

- DAX – Opportunity to sell with the short-term trend at the start of the session

DAX - Opportunity to sell with the short-term trend at the start of the session

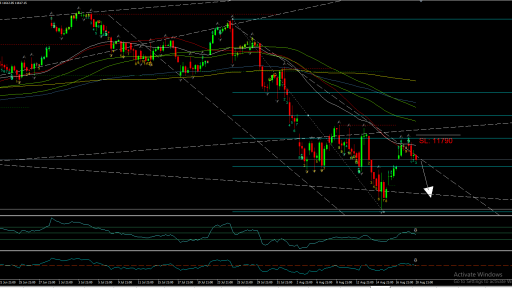

DAX H4 Our Expectations - Declining Short-Term Trend, Horizontal and Diagonal Resistance. Possibility for short positions with stop 11790.

Alternative scenario: A deeper correction is possible if the price rises and keeps levels above the horizontal and diagonal resistance. With a break of 50% Fibonacci and a rise above the 200 period, we have enough evidence to consider this short-term trend as over. The formed trend-reversing H&S formation will be activated at a break of more than 38.2% Fibo and a successful zone test. The formation target is about 12,350.

Comment: Declining short-term trend. Correction to horizontal and diagonal resistance. The price made 2 attempts to break through 38.2% Fibonacci, an area that also matched 50 MA on 4 hours chart, forming a new local minimum where it closed. CCI 50 is below 0, which indicates that the main trend in this time frame is short. The RSI 14 again tested below 50, signaling the end of the correction and resuming the downward momentum.

Fundamental: The economy in the bloc grows at a slow pace in the third quarter of the year. The first signals of a decline in the labor market are observed. The economic outlook in Germany remains unclear and hangs only on exports. Economic activity may further contract in the summer due to low industrial activity. It is not clear whether exports will remain at a level before the domestic economy becomes more exposed to external risks Given the current developments, a new economic contraction will not be surprising. As has been shared in the past weeks, the dichotomy of the German economy (production and service performance) will eventually fall, and the chances of a negative effect on other sectors will become noticeable every day. PMI data on Thursday may give us indications of this, but government officials hope the services sector will continue to support the economy during these difficult times.

Entry: For proper positioning, we wait 30 minutes after the session opens. The reason for this is to wait for the noise from allotraders that will enter the market immediately after the start of the trading session. We are positioned in the direction of cash flows. From the end of the US session and the Asian session, we can conclude that negative sentiment will also be directed to Europe. In this case, a downside is expected with DAX. We are awaiting correction of the initial downward momentum and positioned at the 30th minute for a better price.

SL = 11,790

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.