- Home

- >

- Daily Accents

- >

- Despite the stock rally, traders are trying to boycott it

Despite the stock rally, traders are trying to boycott it

Bank of America Merrill Lynch has made a survey of investors with more than $ 515 billion, which makes it clear that they are not convinced by the New Year's rally, which continues until now and still prefers to stay in cash.

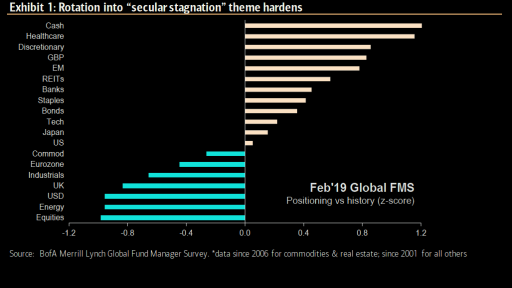

Positioning in world stocks in February has fallen to its lowest level since September 2016, according to BofA. Although the MSCI All Country World Index is up nearly 8% since the beginning of the year. This shows a deep lack of confidence in the stability of the retreating rally among traders.

Instead, they moved back into cash positions, reflecting a 44% net cache growth, the highest percentage since the last financial crisis. Still, the BofA strategists believe that investor volatility will be scattered in the first quarter of 2019, which will bring them back to the stock.

"This month, we saw a big spin of equity from equity to cash." - the strategists say. "This does not show an improvement in investor sentiment."

The move to US stocks has fallen to its lowest level from 9 months to 3%, with the region the second least favored among investors. By contrast, the Eurozone shares have a strong interest and a 5% jump in positioning, interrupting the 18-month negative series for the stock. Exposures to equities from emerging markets continue to grow.

Source: Bloomberg Finance L.P.

Graphs: Used with permission of Bloomberg Finance L.P.

Trader Martin Nikolov

Trader Martin Nikolov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.