- Home

- >

- Stocks Daily Forecasts

- >

- Despite the warning sentiment, big names dig into the riskiest segments of the markets

Despite the warning sentiment, big names dig into the riskiest segments of the markets

Investors who manage over $ 1.6 trillion in total are so confident that the rise in markets in the new year is due that they are targeting some of the most risky segments on the market in the late cycle: Small caps.

Neuberger Berman Group and Legal & General Investment Management are among those who are deaf to Wall Street warnings and go into the most volatile debt-ridden shares to take advantage of what may be the last breath of the bull market .

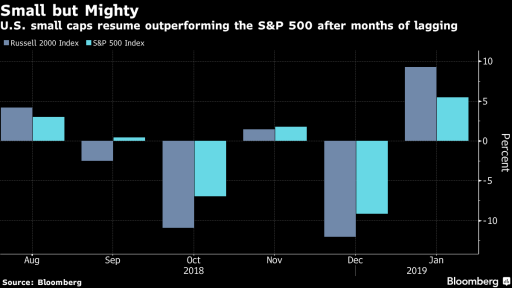

Good for now. Russell 2000 is with 9.3% increase for the year, compared with 5.5% for the S & P 500, becoming leaders for January.

Now, their performance is expected to test the strength of the trend as the corporate season is gaining momentum.

Small Caps. Is a proven compass for the broader market. They signaled the bottom of the &P 500 in 2011 and 2015 and then pulled out their big colleagues from the hole.

"From now on, all market participants know that the crisis is a serious opportunity at the end of the cycle," said Erik Knutzen, co-chair of the Asset Allocation Committee at Neuberger Berman.

Surely, companies with small market capitalization are a good tool for analyzing the broad market. Following the negative performance of the global indices in October and then December, this rise in January may be an early indication of a resuming to the longest bull trend in history.

Source: Bloomberg Finance L.P.

Graphics: Used with permission from Bloomberg Finance L.P.

Original Post: Defying Warnings, Big-Name Bulls Dive Into Riskiest Stocks

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.