- Home

- >

- Stocks Daily Forecasts

- >

- Devastating session on Wall Street and key Asia hours for the futures of SPX

Devastating session on Wall Street and key Asia hours for the futures of SPX

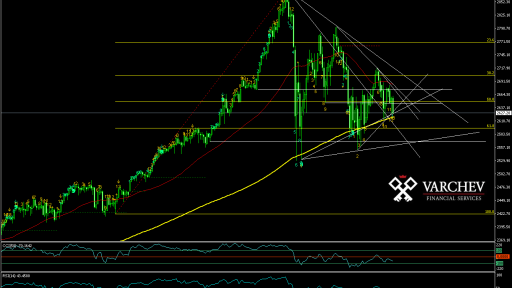

SPX at key levels after a strong bearish bar during the US Session that tests the bottom of the previous bar.

Since the price is close to the SMA 200, this creates a probability of collecting Stop Losses that will accumulate purchases. At these levels there are also limited long positions, which may be a prerequisite for a short-term correction.

US stocks closed with declines on Wednesday after Fed kept the interest rates unchanged, mentioning the high inflation.

To position ourself in the direction of the impulse, it's a good idea to wait for a correction first.

The next levels with limited long positions are about 61.8% Fibonacci, as well as a diagonal across the two bottoms of the daily chart - 2531 and 2550. If the downward impulse continues during the Asian session, which is highly probable due to the weak corporate reports from the latter days that fail to restore investor confidence + the Fed's aggressive tone, these levels will be widely seen as last active support for the index.

A quick look at the chart at 1 hour and it is noticed that during the Asian session (green) the movements are not so big and I think that during this night we will not see significant price action.

On the other hand, however, out of the last eight US sessions (colored in blue), 6 have witnessed steep seloffs. This is a prerequisite for consolidation in Asia and Europe and a serious test of the 200 periodic, and even 61.8% Fibo, tomorrow afternoon.

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.