- Home

- >

- FX Daily Forecasts

- >

- Do not be fooled by the weak dollar

Do not be fooled by the weak dollar

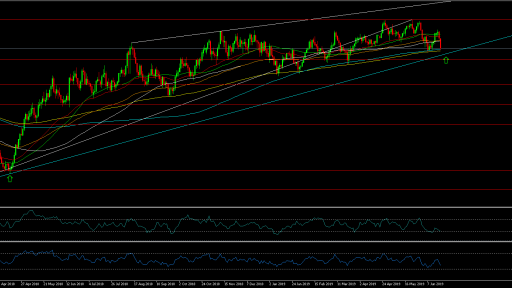

DX (Dollar Index)

Time frame: D1

Technical Analysis: On the chart, we see an exceptionally strong upward trend starting on 16.02.2018. Currently, the price is close to the upward trend line, which has a strong support role. Considering that the FED will not lower interest rates by 2020, it is possible that this support will endure and see a new upward movement.

Conversely, if the dollar increases most of the other currency's will fall.

Let's look at the EUR/USD chart

Mirroring DX, the price is currently about 50 pips of strong diagonal resistance that has not been tested since the start of the downward movement. In addition to this resistance come 200 EMA, SMA, which play a role of strong resistance due to their interlacing.

If the price is able to reach the trend line and test 200 averages, we may see a new strong downward movement.

GBP/USD

The pair managed to reach a strong downward trend line but still keep above the Fibonacci 23.6 level, indicating that the bulls have remained strong. The possible scenario here is a 38.2% Fibonacci test, from where strong sales will follow. Around this level are also 200 periodic moving averages, which at this stage play a role of resistance.

GOLD

Once gold confirmed the support of the upward channel, it jumped toward the north, piercing the previous peak. The price has now reached the channel's upper resistance from where it is likely to start a new consolidation similar to the previous one. Meanwhile, there is also a level 38.2 Fibonacci, which plays a role of strong resistance. Fibonacci's projection is from the top at level 1920.75 to the bottom at 1046.23.

Trader Milko Zashev

Trader Milko Zashev Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.