- Home

- >

- Stocks Daily Forecasts

- >

- Does the stock market need an AI-Powered Dark Pool system?

Does the stock market need an AI-Powered Dark Pool system?

Mathematical formulas, carved in red and black, cover a glass wall. The cabinet is small, but the three men working there dressed in jeans and running shoes running around a number of computers have big plans. They want to run a stock market and say that the three, together with their algorithms, can do what even the weakest of their competitors will need 80 people.

Kelly Littlepage, Stephen Johnson, and Richard Suth. The three entrepreneurs say that their OneChronos company will completely change the business to buy and sell shares created more than two centuries ago by the NYSE.

OneChronos strives to be the first place where securities are traded through artificial intelligence that conducts deals. While stock exchanges use relatively simple mathematics to suit buyers and sellers trading in individual companies, OneChronos offers a mix of transactions between multiple stocks that trade in different currencies at the same time. That would be impossible on the stock exchange that we are all familiar with. In other words, if we take into account the NYSE, every traded share there is traded through USD.

The company is currently awaiting approval by the US Securities and Exchange Commission and by the Financial Market Regulator, known as the Dark Pool (Alternative Trading System, which enables investors to place orders and carry out transactions without publicly disclose their intentions while searching for a buyer or seller.) Assuming that regulators will give a chance to OneChronos, the company will collect its first buyers and sellers later this year. Littlepage, Johnson, and Suth, who have the same views on the company's management, are planning to add European stocks and currencies as soon as possible. "Our market is for someone who wants to sell Apple and then buy European assets by making a currency deal at once," said Littlepage, the founder of OneChronos. "If we do not use AI, doing a deal would take more time than the remaining time in the universe." - says Littlepage.

At the moment of financial markets, AI is mainly used to generate commercial ideas and their implementation. OneChronos is a different idea. The company relies on doing deals at times faster than its traditional competitors. Fees will be significantly lower but the company wants to prove that the market will react more to the volume generated by their transactions than those of the current exchanges.

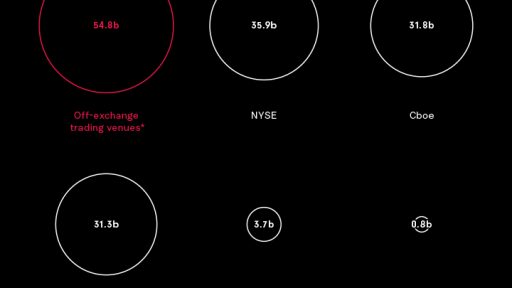

Source: Bloomberg Pro Terminal

Graphic: Used with permission of Bloomberg Finance L.P.

Trader Petar Milanov

Trader Petar Milanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.