- Home

- >

- Daily Accents

- >

- Dollar benefits from Powell’s optimism

Dollar benefits from Powell's optimism

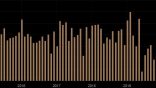

The dollar rose across the board on Wednesday, climbing to a six-month high against the yen, after Federal Reserve Chairman Jerome Powell gave an upbeat outlook for the U.S. economy and reinforced views that the Fed was on track to steadily hike interest rates.

In closely watched congressional testimony on Tuesday, Powell said he saw the United States on course for years more of steady growth, while largely discounting the risks associated with a trade war.

An easing of risk aversion was reflected on Wall Street, which rose overnight and supported Asian stocks on Wednesday after Powell's optimistic analysis of the U.S. economy.

"The dollar stands to gain further, particularly against the yen, with risk aversion in the equity markets petering out," said Junichi Ishikawa, senior FX strategist at IG Securities in Tokyo.

"And while long-term Treasury yields are not rising prominently, this is a reflection of investor demand for U.S. assets that generates a degree of dollar-buying."

On top of the dollar's broad strength, sterling has come also under pressure from disquiet over British politics.

"There are no real reasons to sell the dollar at the moment, and even the trade problem will lead to increased demand for the dollar," said Yukio Ishizuki, senior currency strategist at Daiwa Securities.

"Currencies that tend to be bought when markets turn risk off are the dollar and the yen, so the yen would strengthen against the dollar while the dollar would strengthen against other currencies," he said.

Bloomberg

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.