- Home

- >

- Daily Accents

- >

- Dollar bulls have a lot to worry about in second half of 2017

Dollar bulls have a lot to worry about in second half of 2017

The poor performance of the U.S. dollar during the first half of 2017 is not all that surprising given how varied forecasts were at the end of last year. End-of-2017 target levels for the euro-dollar pair, for example, ranged from just below parity at 97 cents to as high as $1.15 by the end of 2017. Many of the bullish calls for the dollar were driven by a rapid rise of the greenback following the U.S. presidential election, which brought Donald Trump to the White House.

The thinking went that Trump administration along with the Republican-controlled Congress will be able to inject a massive stimulus into the economy via tax cuts and infrastructure spending, accelerating the pace of rate increases. But despite three rate increases since last December, the dollar fell against the euro to its lowest level in a year. The dollar also weakened against the British pound and the Japanese yen. In hindsight, it is clear why the dollar underperformed major rivals by about 5 to 8% over the past six months. Since the start of the year, softer economic data in the U.S. and relative improvement in the eurozone coincided with a shift in expectations of successful implementation of tax reforms and infrastructure spending.

It is widely accepted that the lawmakers cannot start working on the tax legislation until the health care bill is either passed or abandoned. Either way, many market participants view the effort as a waste of political capital by the Trump administration and question the ability to win passage of more market-sensitive proposals. The U.S. economy grew at a 1.4% annualized pace during the first quarter and, according to the Atlanta Fed’s GDPNow model, second-quarter growth is forecast at 2.9%. But weaker-than-expected inflation data have been a concern for strategists.

“Slow pace of tapering and inflation pressure will be the primary driver of euro weakness in the second half. But a mid-cycle correction in risky assets such as equities could also weaken the euro,” according to Kamal Sharma, G-10 FX strategist at Bank of America Merrill Lynch.

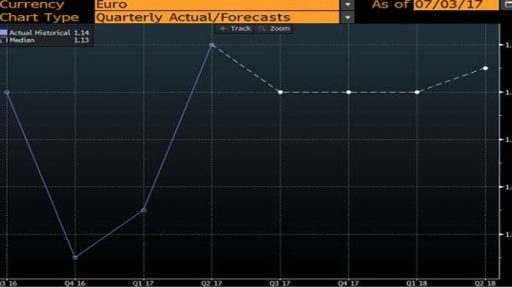

Data from the Bloomberg FX Forecasts show lower levels for the EUR/USD but not as deep as down to $1.08.

Source: Bloomberg Terminal

Trader - S. Fuchedzhiev

Varchev Traders

Varchev Traders Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.