- Home

- >

- FX Daily Forecasts

- >

- The Fed may be about to spur a dollar slump

The Fed may be about to spur a dollar slump

The future of the dollar will be decided today: contrary to the general opinion, I expect declines

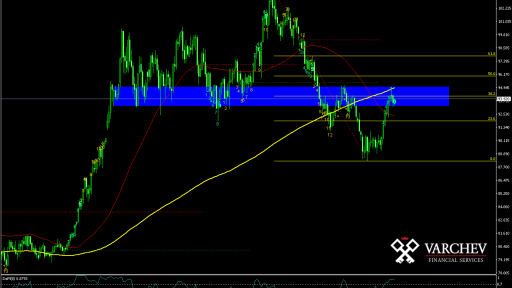

The dollar index is traded at a critical technical level of less than 0.1% of a 7-month high. He makes his fifth attempt to break up for just two weeks as the Fed's decision is approaching. Successfully closing from above and the signal will be clear - the dollar is ready to continue to rise. Failure and bulls will lose hope.

The key to the next major move lies in the return of bond yields to the central bank's decision. It is important to note that the chances of an aggressive (hawkish) Fed are very high due to the combination of strong economic data and the desire of bankers to normalize monetary policy.

But I think the move will be negative as I do not think an aggressive tone will blunt the yield curve: yields on 10-year bonds are likely to fall at the rate hike.

Macro-economic factors of fundamental analysis

It is important to recall that bond yields are not a direct function of economic power. Growth indirectly paves the way for bond movement through inflation expectations. There are several reasons to believe that inflation will fall. The more aggressive the Fed is, the less chance inflation escapes up: the yield curve has room for shrinking.

The rising fiscal deficit also puts long-term government bond yields under pressure, but this dynamics is moving slower and will not dominate markets this week. If anything, concerns about the US double deficit intensify the bearish dollar case. Especially since there are growing signs that Trump's trading approach undermines the geopolitical position of the United States and hence the role of the dollar as a world reserve currency. A story of Mexico tonight, turning to Japan, trying to diversify its trade while Naphtha's stumbling stumbling, just highlights this topic.

All of this fits into the idea that if the dollar is to fail again today, the long-term downward trend may be on the agenda again.

Source: Bloomberg Pro Terminal

Trader Aleksandar Kumanov

Trader Aleksandar Kumanov Read more:

If you think, we can improve that section,

please comment. Your oppinion is imortant for us.